Page 172 - ELT_3rd_1st May 2020_Vol 372_Part

P. 172

394 EXCISE LAW TIMES [ Vol. 372

.Trading Company, Madurai - revealed that the goods in stock were in excess of

the goods accounted for in the stock transfer documents; clandestine clearance of

goods was further corroborated from the searches conducted at Usha Trading

Company, Madurai and the statement of Shri Vijayan, proprietor. Shri Ebenezer,

in charge of Madurai unit, stated that they were involved in the trade of PPMF

yarn; they do not sell goods as mono filament yarn; he accepted the receipt of

excess quantity than mentioned in stock transfer bills and such excess quantity

was sold to M/s. Usha traders without bills. He submits that the fact of suppres-

sion by the appellant was proved beyond doubt during investigation; hence, the

plea of limitation of demand does not sustain.

6. Heard both sides and perused the records of the case. Brief issues

that requires to be considered in this case are as to whether the synthetic filament

yarn manufactured by the appellant falls under 5402 of CETA as contended by

the department or under 5404 as contended by the appellants and as to whether

the test result would be applicable prospectively or retrospectively. The appel-

lants are small scale unit and are engaged in the manufacture of synthetic fila-

ment yarn of 600d and above and have classified the same under 5404 of CETA,

1985. The Superintendent in-charge of the appellant got the item tested by the

Textile Committee who vide report dated 6-8-2004 concluded that the impugned

goods were polypropylene monofilament yarn of 600 d or more and of which, no

cross-section dimension exceeds 1 mm. On the basis of this letter, the appellant

surrendered their Central Excise registration and submitted a letter to the de-

partment on 15-3-2005 stating that no duty was payable on the impugned goods

in terms of Notification No. 7/2003-C.E., dated 1-3-2003. After an investigation

conducted by DGCEI, the samples were got tested by Chemical Examiner who

reported that the impugned goods were blacked coloured multi-filament yarn;

composed of polypropylene and denier was 610.4 without tolerance. On the basis

of this report, the Department contended that the impugned goods fall under

5402 of CETA 1985 and therefore, are not eligible for the exemption contained in

Notification Nos. 7/2003-C.E. and No. 30/2004-C.E. during the relevant period.

Accordingly, the present proceedings have been initiated.

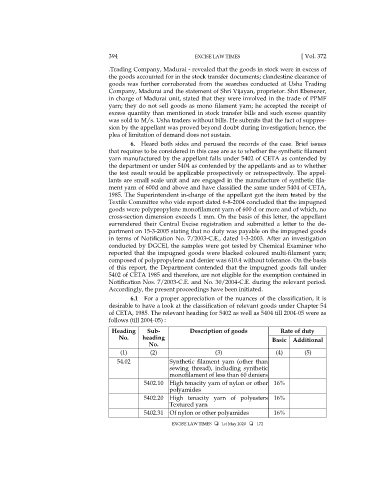

6.1 For a proper appreciation of the nuances of the classification, it is

desirable to have a look at the classification of relevant goods under Chapter 54

of CETA, 1985. The relevant heading for 5402 as well as 5404 till 2004-05 were as

follows (till 2004-05) :

Heading Sub- Description of goods Rate of duty

No. heading Basic Additional

No.

(1) (2) (3) (4) (5)

54.02 Synthetic filament yarn (other than

sewing thread), including synthetic

monofilament of less than 60 deniers

5402.10 High tenacity yarn of nylon or other 16%

polyamides

5402.20 High tenacity yarn of polyesters 16%

Textured yarn

5402.31 Of nylon or other polyamides 16%

EXCISE LAW TIMES 1st May 2020 172