Page 192 - ELT_3rd_1st May 2020_Vol 372_Part

P. 192

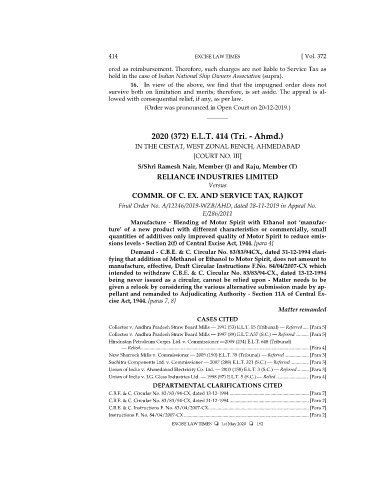

414 EXCISE LAW TIMES [ Vol. 372

ered as reimbursement. Therefore, such charges are not liable to Service Tax as

held in the case of Indian National Ship Owners Association (supra).

16. In view of the above, we find that the impugned order does not

survive both on limitation and merits; therefore, is set aside. The appeal is al-

lowed with consequential relief, if any, as per law.

(Order was pronounced in Open Court on 20-12-2019.)

_______

2020 (372) E.L.T. 414 (Tri. - Ahmd.)

IN THE CESTAT, WEST ZONAL BENCH, AHMEDABAD

[COURT NO. III]

S/Shri Ramesh Nair, Member (J) and Raju, Member (T)

RELIANCE INDUSTRIES LIMITED

Versus

COMMR. OF C. EX. AND SERVICE TAX, RAJKOT

Final Order No. A/12246/2019-WZB/AHD, dated 28-11-2019 in Appeal No.

E/286/2011

Manufacture - Blending of Motor Spirit with Ethanol not ‘manufac-

ture’ of a new product with different characteristics or commercially, small

quantities of additives only improved quality of Motor Spirit to reduce emis-

sions levels - Section 2(f) of Central Excise Act, 1944. [para 4]

Demand - C.B.E. & C. Circular No. 83/83/94CX., dated 31-12-1994 clari-

fying that addition of Methanol or Ethanol to Motor Spirit, does not amount to

manufacture, effective, Draft Circular Instructions F.No. 84/04/2007-CX which

intended to withdraw C.B.E. & C. Circular No. 83/83/94-CX., dated 13-12-1994

being never issued as a circular, cannot be relied upon - Matter needs to be

given a relook by considering the various alternative submission made by ap-

pellant and remanded to Adjudicating Authority - Section 11A of Central Ex-

cise Act, 1944. [paras 7, 8]

Matter remanded

CASES CITED

Collector v. Andhra Pradesh Straw Board Mills — 1991 (53) E.L.T. 15 (Tribunal) — Referred ..... [Para 5]

Collector v. Andhra Pradesh Straw Board Mills — 1997 (89) E.L.T.A37 (S.C.) — Referred ........... [Para 5]

Hindustan Petroleum Corpn. Ltd. v. Commissioner —2009 (234) E.L.T. 648 (Tribunal)

— Relied ............................................................................................................................................. [Para 4]

New Sharrock Mills v. Commissioner — 2005 (190) E.L.T. 35 (Tribunal) — Referred .................... [Para 3]

Suchitra Components Ltd. v. Commissioner — 2007 (208) E.L.T. 321 (S.C.) — Referred ............... [Para 3]

Union of India v. Ahmedabad Electricity Co. Ltd. — 2003 (158) E.L.T. 3 (S.C.) — Referred .......... [Para 3]

Union of India v. J.G. Glass Industries Ltd. — 1998 (97) E.L.T. 5 (S.C.) — Relied ........................... [Para 4]

DEPARTMENTAL CLARIFICATIONS CITED

C.B.E. & C. Circular No. 83/83/94-CX, dated 13-12-1994 .................................................................. [Para 7]

C.B.E. & C. Circular No. 83/83/94-CX, dated 31-12-1994 .................................................................. [Para 2]

C.B.E. & C. Instructions F. No. 83/04/2007-CX .................................................................................... [Para 7]

Instructions F. No. 84/04/2007-CX ........................................................................................................ [Para 2]

EXCISE LAW TIMES 1st May 2020 192