Page 237 - ELT_1st June 2020_VOL 372_Part 5th

P. 237

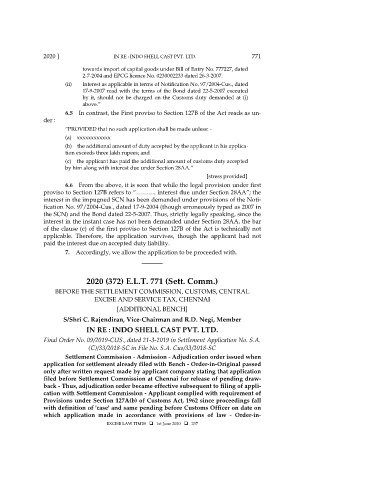

2020 ] IN RE : INDO SHELL CAST PVT. LTD. 771

towards import of capital goods under Bill of Entry No. 777227, dated

2-7-2004 and EPCG licence No. 0230002233 dated 26-3-2007.

(ii) Interest as applicable in terms of Notification No. 97/2004-Cus., dated

17-9-2007 read with the terms of the Bond dated 22-5-2007 executed

by it, should not be charged on the Customs duty demanded at (i)

above.”

6.5 In contrast, the First proviso to Section 127B of the Act reads as un-

der :

“PROVIDED that no such application shall be made unless: -

(a) xxxxxxxxxxxx

(b) the additional amount of duty accepted by the applicant in his applica-

tion exceeds three lakh rupees; and

(c) the applicant has paid the additional amount of customs duty accepted

by him along with interest due under Section 28AA.”

[stress provided]

6.6 From the above, it is seen that while the legal provision under first

proviso to Section 127B refers to “………. interest due under Section 28AA”; the

interest in the impugned SCN has been demanded under provisions of the Noti-

fication No. 97/2004-Cus., dated 17-9-2004 (though erroneously typed as 2007 in

the SCN) and the Bond dated 22-5-2007. Thus, strictly legally speaking, since the

interest in the instant case has not been demanded under Section 28AA, the bar

of the clause (c) of the first proviso to Section 127B of the Act is technically not

applicable. Therefore, the application survives, though the applicant had not

paid the interest due on accepted duty liability.

7. Accordingly, we allow the application to be proceeded with.

_______

2020 (372) E.L.T. 771 (Sett. Comm.)

BEFORE THE SETTLEMENT COMMISSION, CUSTOMS, CENTRAL

EXCISE AND SERVICE TAX, CHENNAI

[ADDITIONAL BENCH]

S/Shri C. Rajendiran, Vice-Chairman and R.D. Negi, Member

IN RE : INDO SHELL CAST PVT. LTD.

Final Order No. 09/2019-CUS., dated 21-3-2019 in Settlement Application No. S.A.

(C)/33/2018-SC in File No. S.A. Cus/33/2018-SC

Settlement Commission - Admission - Adjudication order issued when

application for settlement already filed with Bench - Order-in-Original passed

only after written request made by applicant company stating that application

filed before Settlement Commission at Chennai for release of pending draw-

back - Thus, adjudication order became effective subsequent to filing of appli-

cation with Settlement Commission - Applicant complied with requirement of

Provisions under Section 127A(b) of Customs Act, 1962 since proceedings fall

with definition of 'case' and same pending before Customs Officer on date on

which application made in accordance with provisions of law - Order-in-

EXCISE LAW TIMES 1st June 2020 237