Page 102 - ELT_1st July 2020_Vol 373_Part 1

P. 102

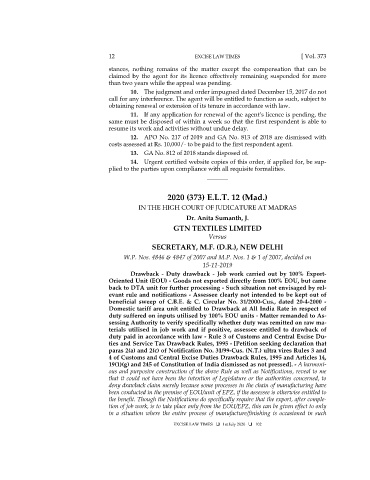

12 EXCISE LAW TIMES [ Vol. 373

stances, nothing remains of the matter except the compensation that can be

claimed by the agent for its licence effectively remaining suspended for more

than two years while the appeal was pending.

10. The judgment and order impugned dated December 15, 2017 do not

call for any interference. The agent will be entitled to function as such, subject to

obtaining renewal or extension of its tenure in accordance with law.

11. If any application for renewal of the agent’s licence is pending, the

same must be disposed of within a week so that the first respondent is able to

resume its work and activities without undue delay.

12. APO No. 217 of 2019 and GA No. 813 of 2018 are dismissed with

costs assessed at Rs. 10,000/- to be paid to the first respondent agent.

13. GA No. 812 of 2018 stands disposed of.

14. Urgent certified website copies of this order, if applied for, be sup-

plied to the parties upon compliance with all requisite formalities.

_______

2020 (373) E.L.T. 12 (Mad.)

IN THE HIGH COURT OF JUDICATURE AT MADRAS

Dr. Anita Sumanth, J.

GTN TEXTILES LIMITED

Versus

SECRETARY, M.F. (D.R.), NEW DELHI

W.P. Nos. 4846 & 4847 of 2007 and M.P. Nos. 1 & 1 of 2007, decided on

15-11-2019

Drawback - Duty drawback - Job work carried out by 100% Export-

Oriented Unit (EOU) - Goods not exported directly from 100% EOU, but came

back to DTA unit for further processing - Such situation not envisaged by rel-

evant rule and notifications - Assessee clearly not intended to be kept out of

beneficial sweep of C.B.E. & C. Circular No. 31/2000-Cus., dated 20-4-2000 -

Domestic tariff area unit entitled to Drawback at All India Rate in respect of

duty suffered on inputs utilised by 100% EOU units - Matter remanded to As-

sessing Authority to verify specifically whether duty was remitted on raw ma-

terials utilised in job work and if positive, assessee entitled to drawback of

duty paid in accordance with law - Rule 3 of Customs and Central Excise Du-

ties and Service Tax Drawback Rules, 1995 - [Petition seeking declaration that

paras 2(a) and 2(c) of Notification No. 31/99-Cus. (N.T.) ultra vires Rules 3 and

4 of Customs and Central Excise Duties Drawback Rules, 1995 and Articles 14,

19(1)(g) and 245 of Constitution of India dismissed as not pressed]. - A harmoni-

ous and purposive construction of the above Rule as well as Notifications, reveal to me

that it could not have been the intention of Legislature or the authorities concerned, to

deny drawback claim merely because some processes in the chain of manufacturing have

been conducted in the premise of EOU/unit of EPZ, if the assessee is otherwise entitled to

the benefit. Though the Notifications do specifically require that the export, after comple-

tion of job work, is to take place only from the EOU/EPZ, this can be given effect to only

in a situation where the entire process of manufacture/finishing is occasioned in such

EXCISE LAW TIMES 1st July 2020 102