Page 117 - ELT_1st July 2020_Vol 373_Part 1

P. 117

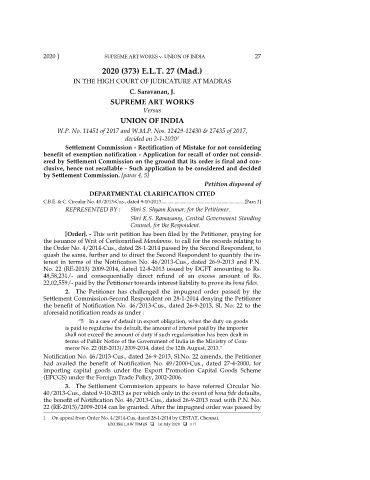

2020 ] SUPREME ART WORKS v. UNION OF INDIA 27

2020 (373) E.L.T. 27 (Mad.)

IN THE HIGH COURT OF JUDICATURE AT MADRAS

C. Saravanan, J.

SUPREME ART WORKS

Versus

UNION OF INDIA

W.P. No. 11451 of 2017 and W.M.P. Nos. 12429-12430 & 27435 of 2017,

decided on 2-1-2020

1

Settlement Commission - Rectification of Mistake for not considering

benefit of exemption notification - Application for recall of order not consid-

ered by Settlement Commission on the ground that its order is final and con-

clusive, hence not recallable - Such application to be considered and decided

by Settlement Commission. [paras 4, 5]

Petition disposed of

DEPARTMENTAL CLARIFICATION CITED

C.B.E. & C. Circular No. 40/2013-Cus., dated 9-10-2013 ..................................................................... [Para 3]

REPRESENTED BY : Shri S. Shyam Kumar, for the Petitioner.

Shri K.S. Ramasamy, Central Government Standing

Counsel, for the Respondent.

[Order]. - This writ petition has been filed by the Petitioner, praying for

the issuance of Writ of Certiorarified Mandamus, to call for the records relating to

the Order No. 4/2014-Cus., dated 28-1-2014 passed by the Second Respondent, to

quash the same, further and to direct the Second Respondent to quantify the in-

terest in terms of the Notification No. 46/2013-Cus., dated 26-9-2013 and P.N.

No. 22 (RE-2013) 2009-2014, dated 12-8-2013 issued by DGFT amounting to Rs.

48,58,231/- and consequentially direct refund of an excess amount of Rs.

22,02,559/- paid by the Petitioner towards interest liability to prove its bona fides.

2. The Petitioner has challenged the impugned order passed by the

Settlement Commission-Second Respondent on 28-1-2014 denying the Petitioner

the benefit of Notification No. 46/2013-Cus., dated 26-9-2013, Sl. No. 22 to the

aforesaid notification reads as under :

“5 In a case of default in export obligation, when the duty on goods

is paid to regularise the default, the amount of interest paid by the importer

shall not exceed the amount of duty if such regularisation has been dealt in

terms of Public Notice of the Government of India in the Ministry of Com-

merce No. 22 (RE-2013)/2009-2014, dated the 12th August, 2013.”

Notification No. 46/2013-Cus., dated 26-9-2013, Sl.No. 22 amends, the Petitioner

had availed the benefit of Notification No. 49/2000-Cus., dated 27-4-2000, for

importing capital goods under the Export Promotion Capital Goods Scheme

(EPCGS) under the Foreign Trade Policy, 2002-2006.

3. The Settlement Commission appears to have referred Circular No.

40/2013-Cus., dated 9-10-2013 as per which only in the event of bona fide defaults,

the benefit of Notification No. 46/2013-Cus., dated 26-9-2013 read with P.N. No.

22 (RE-2013)/2009-2014 can be granted. After the impugned order was passed by

________________________________________________________________________

1 On appeal from Order No. 4/2014-Cus, dated 28-1-2014 by CESTAT, Chennai.

EXCISE LAW TIMES 1st July 2020 117