Page 139 - ELT_1st July 2020_Vol 373_Part 1

P. 139

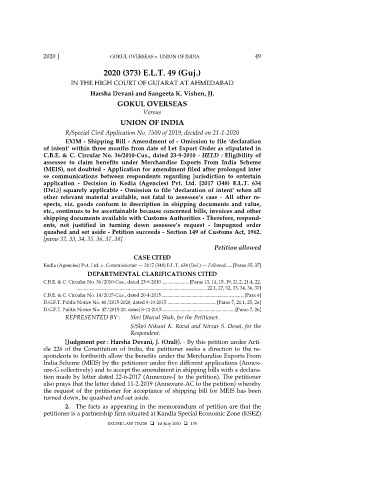

2020 ] GOKUL OVERSEAS v. UNION OF INDIA 49

2020 (373) E.L.T. 49 (Guj.)

IN THE HIGH COURT OF GUJARAT AT AHMEDABAD

Harsha Devani and Sangeeta K. Vishen, JJ.

GOKUL OVERSEAS

Versus

UNION OF INDIA

R/Special Civil Application No. 7500 of 2019, decided on 21-1-2020

EXIM - Shipping Bill - Amendment of - Omission to file ‘declaration

of intent’ within three months from date of Let Export Order as stipulated in

C.B.E. & C. Circular No. 36/2010Cus., dated 23-9-2010 - HELD : Eligibility of

assessee to claim benefits under Merchandise Exports From India Scheme

(MEIS), not doubted - Application for amendment filed after prolonged inter

se communications between respondents regarding jurisdiction to entertain

application - Decision in Kedia (Agencies) Pvt. Ltd. [2017 (348) E.L.T. 634

(Del.)] squarely applicable - Omission to file ‘declaration of intent’ when all

other relevant material available, not fatal to assessee’s case - All other re-

spects, viz. goods conform to description in shipping documents and value,

etc., continues to be ascertainable because concerned bills, invoices and other

shipping documents available with Customs Authorities - Therefore, respond-

ents, not justified in turning down assessee’s request - Impugned order

quashed and set aside - Petition succeeds - Section 149 of Customs Act, 1962.

[paras 32, 33, 34, 35, 36, 37, 38]

Petition allowed

CASE CITED

Kedia (Agencies) Pvt. Ltd. v. Commissioner — 2017 (348) E.L.T. 634 (Del.) — Followed ..... [Paras 35, 37]

DEPARTMENTAL CLARIFICATIONS CITED

C.B.E. & C. Circular No. 36/2010-Cus., dated 23-9-2010 ....................... [Paras 13, 14, 15, 19, 21.2, 21.4, 22,

............................................................................................................. 22.1, 27, 32, 33, 34, 36, 37]

C.B.E. & C. Circular No. 14/2015-Cus., dated 20-4-2015 ..................................................................... [Para 6]

D.G.F.T. Public Notice No. 40/2015-2020, dated 9-10-2015 ......................................... [Paras 7, 21.1, 25, 26]

D.G.F.T. Public Notice No. 47/2015-20, dated 8-12-2015............................................................. [Paras 7, 26]

REPRESENTED BY : Shri Dhaval Shah, for the Petitioner.

S/Shri Nikunt K. Raval and Nirzar S. Desai, for the

Respondent.

[Judgment per : Harsha Devani, J. (Oral)]. - By this petition under Arti-

cle 226 of the Constitution of India, the petitioner seeks a direction to the re-

spondents to forthwith allow the benefits under the Merchandise Exports From

India Scheme (MEIS) by the petitioner under five different applications (Annex-

ure-G collectively) and to accept the amendment in shipping bills with a declara-

tion made by letter dated 22-6-2017 (Annexure-J to the petition). The petitioner

also prays that the letter dated 11-2-2019 (Annexure-AC to the petition) whereby

the request of the petitioner for acceptance of shipping bill for MEIS has been

turned down, be quashed and set aside.

2. The facts as appearing in the memorandum of petition are that the

petitioner is a partnership firm situated at Kandla Special Economic Zone (KSEZ)

EXCISE LAW TIMES 1st July 2020 139