Page 163 - ELT_1st July 2020_Vol 373_Part 1

P. 163

2020 ] MULTITEX FILTRATION ENGINEERS LIMITED v. UNION OF INDIA 73

listed in paragraph 8.3(a) and (b) of FTP, whichever is applicable. However,

supply of goods required for setting up of any mega power project as speci-

fied in S.No. 400 of DoR Notification No. 21/2002-Customs, dated 1-3-2002,

as amended, shall be eligible for deemed export benefits as mentioned in

paragraph 8.3(a), (b) and (c) of FTP, whichever is applicable, if such mega

power project complies with the threshold generation capacity specified

therein, in Customs Notification.”

11. The sole ground for rejection of the claim in the impugned commu-

nication is that since the supplies made to power project under ICB, in terms of

para 8.3(c) of the FTP, as clarified by policy Circular No. 16, dated 15th March

2013, are ab initio exempted from payment of excise duty, the refund of TED does

not arise. At this juncture, it would also be worthwhile to take note of the policy

Circular No. 16, dated 15th March, 2013 which reads as under :

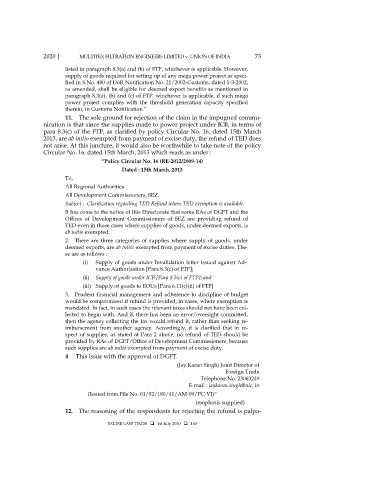

“Policy Circular No. 16 (RE-2012/2009-14)

Dated : 15th March, 2013

To,

All Regional Authorities

All Development Commissioners, SEZ.

Subject : Clarification regarding TED Refund where TED exemption is available.

It has come to the notice of this Directorate that some RAs of DGFT and the

Offices of Development Commissioners of SEZ are providing refund of

TED even in those cases where supplies of goods, under deemed exports, is

ab initio exempted.

2. There are three categories of supplies where supply of goods, under

deemed exports, are ab initio exempted from payment of excise duties. The-

se are as follows :

(i) Supply of goods under Invalidation letter issued against Ad-

vance Authorisation [Para 8.3(c) of FTP];

(ii) Supply of goods under ICB [Para 8.3(c) of FTP]; and

(iii) Supply of goods to EOUs [Para 6.11(c)(ii) of FTP]

3. Prudent financial management and adherence to discipline of budget

would be compromised if refund is provided, in cases, where exemption is

mandated. In fact, in such cases the relevant taxes should not have been col-

lected to begin with. And if, there has been an error/oversight committed,

then the agency collecting the tax would refund it, rather than seeking re-

imbursement from another agency. Accordingly, it is clarified that in re-

spect of supplies, as stated at Para 2 above, no refund of TED should be

provided by RAs of DGFT/Office of Development Commissioners, because

such supplies are ab initio exempted from payment of excise duty.

4. This issue with the approval of DGFT.

(Jay Karan Singh) Joint Director of

Foreign Trade

Telephone No. 23063249

E-mail : jaykaran.singh@nic. in

(Issued from File No. 01/92/180/41/AM-09/PC-VI)”

(emphasis supplied)

12. The reasoning of the respondents for rejecting the refund is palpa-

EXCISE LAW TIMES 1st July 2020 163