Page 175 - ELT_1st July 2020_Vol 373_Part 1

P. 175

2020 ] COMMISSIONER OF CUSTOMS, CHENNAI v. FREIGHT FIELD (MADRAS) PVT. LTD. 85

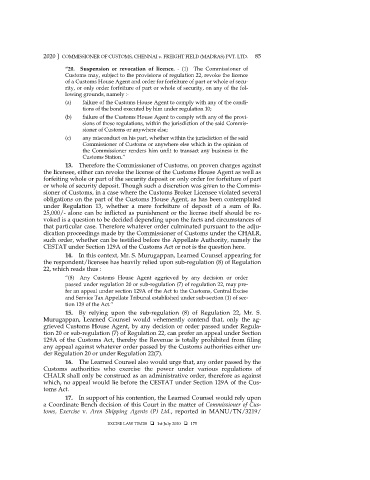

“20. Suspension or revocation of licence. - (1) The Commissioner of

Customs may, subject to the provisions of regulation 22, revoke the licence

of a Customs House Agent and order for forfeiture of part or whole of secu-

rity, or only order forfeiture of part or whole of security, on any of the fol-

lowing grounds, namely :-

(a) failure of the Customs House Agent to comply with any of the condi-

tions of the bond executed by him under regulation 10;

(b) failure of the Customs House Agent to comply with any of the provi-

sions of these regulations, within the jurisdiction of the said Commis-

sioner of Customs or anywhere else;

(c) any misconduct on his part, whether within the jurisdiction of the said

Commissioner of Customs or anywhere else which in the opinion of

the Commissioner renders him unfit to transact any business in the

Customs Station.”

13. Therefore the Commissioner of Customs, on proven charges against

the licensee, either can revoke the license of the Customs House Agent as well as

forfeiting whole or part of the security deposit or only order for forfeiture of part

or whole of security deposit. Though such a discretion was given to the Commis-

sioner of Customs, in a case where the Customs Broker Licensee violated several

obligations on the part of the Customs House Agent, as has been contemplated

under Regulation 13, whether a mere forfeiture of deposit of a sum of Rs.

25,000/- alone can be inflicted as punishment or the license itself should be re-

voked is a question to be decided depending upon the facts and circumstances of

that particular case. Therefore whatever order culminated pursuant to the adju-

dication proceedings made by the Commissioner of Customs under the CHALR,

such order, whether can be testified before the Appellate Authority, namely the

CESTAT under Section 129A of the Customs Act or not is the question here.

14. In this context, Mr. S. Murugappan, Learned Counsel appearing for

the respondent/licensee has heavily relied upon sub-regulation (8) of Regulation

22, which reads thus :

“(8) Any Customs House Agent aggrieved by any decision or order

passed under regulation 20 or sub-regulation (7) of regulation 22, may pre-

fer an appeal under section 129A of the Act to the Customs, Central Excise

and Service Tax Appellate Tribunal established under sub-section (1) of sec-

tion 129 of the Act.”

15. By relying upon the sub-regulation (8) of Regulation 22, Mr. S.

Murugappan, Learned Counsel would vehemently contend that, only the ag-

grieved Customs House Agent, by any decision or order passed under Regula-

tion 20 or sub-regulation (7) of Regulation 22, can prefer an appeal under Section

129A of the Customs Act, thereby the Revenue is totally prohibited from filing

any appeal against whatever order passed by the Customs authorities either un-

der Regulation 20 or under Regulation 22(7).

16. The Learned Counsel also would urge that, any order passed by the

Customs authorities who exercise the power under various regulations of

CHALR shall only be construed as an administrative order, therefore as against

which, no appeal would lie before the CESTAT under Section 129A of the Cus-

toms Act.

17. In support of his contention, the Learned Counsel would rely upon

a Coordinate Bench decision of this Court in the matter of Commissioner of Cus-

toms, Exercise v. Aren Shipping Agents (P) Ltd., reported in MANU/TN/3219/

EXCISE LAW TIMES 1st July 2020 175