Page 41 - ELT_15th July 2020_Vol 373_Part 2

P. 41

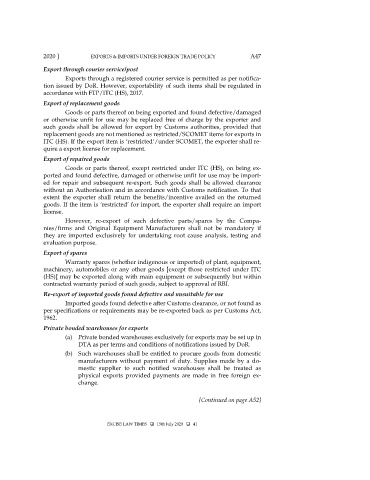

2020 ] EXPORTS & IMPORTS UNDER FOREIGN TRADE POLICY A47

Export through courier service/post

Exports through a registered courier service is permitted as per notifica-

tion issued by DoR. However, exportability of such items shall be regulated in

accordance with FTP/ITC (HS), 2017.

Export of replacement goods

Goods or parts thereof on being exported and found defective/damaged

or otherwise unfit for use may be replaced free of charge by the exporter and

such goods shall be allowed for export by Customs authorities, provided that

replacement goods are not mentioned as restricted/SCOMET items for exports in

ITC (HS). If the export item is ‘restricted’/under SCOMET, the exporter shall re-

quire a export license for replacement.

Export of repaired goods

Goods or parts thereof, except restricted under ITC (HS), on being ex-

ported and found defective, damaged or otherwise unfit for use may be import-

ed for repair and subsequent re-export. Such goods shall be allowed clearance

without an Authorisation and in accordance with Customs notification. To that

extent the exporter shall return the benefits/incentive availed on the returned

goods. If the item is ‘restricted’ for import, the exporter shall require an import

license.

However, re-export of such defective parts/spares by the Compa-

nies/firms and Original Equipment Manufacturers shall not be mandatory if

they are imported exclusively for undertaking root cause analysis, testing and

evaluation purpose.

Export of spares

Warranty spares (whether indigenous or imported) of plant, equipment,

machinery, automobiles or any other goods [except those restricted under ITC

(HS)] may be exported along with main equipment or subsequently but within

contracted warranty period of such goods, subject to approval of RBI.

Re-export of imported goods found defective and unsuitable for use

Imported goods found defective after Customs clearance, or not found as

per specifications or requirements may be re-exported back as per Customs Act,

1962.

Private bonded warehouses for exports

(a) Private bonded warehouses exclusively for exports may be set up in

DTA as per terms and conditions of notifications issued by DoR.

(b) Such warehouses shall be entitled to procure goods from domestic

manufacturers without payment of duty. Supplies made by a do-

mestic supplier to such notified warehouses shall be treated as

physical exports provided payments are made in free foreign ex-

change.

[Continued on page A52]

EXCISE LAW TIMES 15th July 2020 41