Page 117 - ELT_15th August 2020_Vol 373_Part 4

P. 117

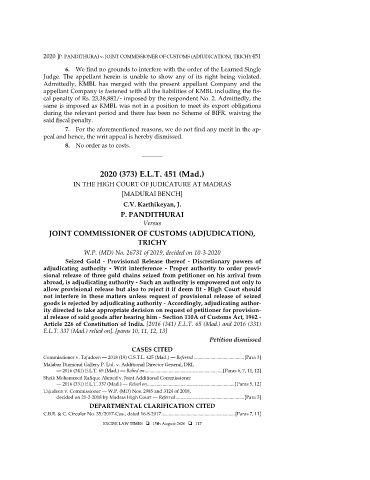

2020 ]P. PANDITHURAI v. JOINT COMMISSIONER OF CUSTOMS (ADJUDICATION), TRICHY 451

6. We find no grounds to interfere with the order of the Learned Single

Judge. The appellant herein is unable to show any of its right being violated.

Admittedly, KMBL has merged with the present appellant Company and the

appellant Company is fastened with all the liabilities of KMBL including the fis-

cal penalty of Rs. 23,38,882/- imposed by the respondent No. 2. Admittedly, the

same is imposed as KMBL was not in a position to meet its export obligations

during the relevant period and there has been no Scheme of BIFR. waiving the

said fiscal penalty.

7. For the aforementioned reasons, we do not find any merit in the ap-

peal and hence, the writ appeal is hereby dismissed.

8. No order as to costs.

_______

2020 (373) E.L.T. 451 (Mad.)

IN THE HIGH COURT OF JUDICATURE AT MADRAS

[MADURAI BENCH]

C.V. Karthikeyan, J.

P. PANDITHURAI

Versus

JOINT COMMISSIONER OF CUSTOMS (ADJUDICATION),

TRICHY

W.P. (MD) No. 26731 of 2019, decided on 10-3-2020

Seized Gold - Provisional Release thereof - Discretionary powers of

adjudicating authority - Writ interference - Proper authority to order provi-

sional release of three gold chains seized from petitioner on his arrival from

abroad, is adjudicating authority - Such an authority is empowered not only to

allow provisional release but also to reject it if deem fit - High Court should

not interfere in these matters unless request of provisional release of seized

goods is rejected by adjudicating authority - Accordingly, adjudicating author-

ity directed to take appropriate decision on request of petitioner for provision-

al release of said goods after hearing him - Section 110A of Customs Act, 1962 -

Article 226 of Constitution of India. [2016 (341) E.L.T. 65 (Mad.) and 2016 (331)

E.L.T. 337 (Mad.) relied on]. [paras 10, 11, 12, 13]

Petition dismissed

CASES CITED

Commissioner v. Tajudeen — 2018 (19) G.S.T.L. 425 (Mad.) — Referred .......................................... [Para 3]

Malabar Diamond Gallery P. Ltd. v. Additional Director General, DRI,

— 2016 (341) E.L.T. 65 (Mad.) — Relied on ................................................................. [Paras 6, 7, 11, 12]

Sheik Mohammed Rafique Ahmed v. Joint Additional Commissioner

— 2016 (331) E.L.T. 337 (Mad.) — Relied on ......................................................................... [Paras 5, 12]

Tajudeen v. Commissioner — W.P. (MD) Nos. 2985 and 3124 of 2018,

decided on 21-2-2018 by Madras High Court — Referred ......................................................... [Para 3]

DEPARTMENTAL CLARIFICATION CITED

C.B.E. & C. Circular No. 35/2017-Cus., dated 16-8-2017 ............................................................. [Paras 7, 11]

EXCISE LAW TIMES 15th August 2020 117