Page 138 - ELT_15th August 2020_Vol 373_Part 4

P. 138

472 EXCISE LAW TIMES [ Vol. 373

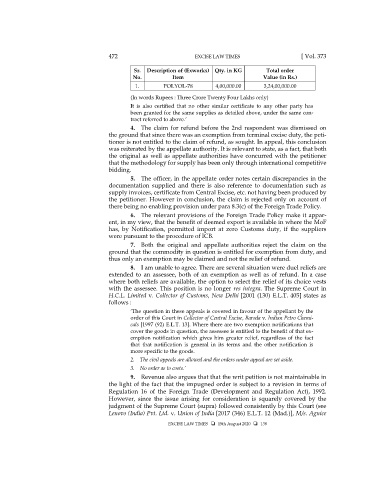

Sr. Description of (Exworks) Qty. in KG Total order

No. Item Value (in Rs.)

1. POLYOL-78 4,00,000.00 3,24,00,000.00

(In words Rupees : Three Crore Twenty Four Lakhs only)

It is also certified that no other similar certificate to any other party has

been granted for the same supplies as detailed above, under the same con-

tract referred to above.’

4. The claim for refund before the 2nd respondent was dismissed on

the ground that since there was an exemption from terminal excise duty, the peti-

tioner is not entitled to the claim of refund, as sought. In appeal, this conclusion

was reiterated by the appellate authority. It is relevant to state, as a fact, that both

the original as well as appellate authorities have concurred with the petitioner

that the methodology for supply has been only through international competitive

bidding.

5. The officer, in the appellate order notes certain discrepancies in the

documentation supplied and there is also reference to documentation such as

supply invoices, certificate from Central Excise, etc. not having been produced by

the petitioner. However in conclusion, the claim is rejected only on account of

there being no enabling provision under para 8.3(c) of the Foreign Trade Policy.

6. The relevant provisions of the Foreign Trade Policy make it appar-

ent, in my view, that the benefit of deemed export is available in where the MoF

has, by Notification, permitted import at zero Customs duty, if the suppliers

were pursuant to the procedure of ICB.

7. Both the original and appellate authorities reject the claim on the

ground that the commodity in question is entitled for exemption from duty, and

thus only an exemption may be claimed and not the relief of refund.

8. I am unable to agree. There are several situation were duel reliefs are

extended to an assessee, both of an exemption as well as of refund. In a case

where both reliefs are available, the option to select the relief of its choice vests

with the assessee. This position is no longer res integra. The Supreme Court in

H.C.L. Limited v. Collector of Customs, New Delhi [2001 (130) E.L.T. 405] states as

follows :

‘The question in these appeals is covered in favour of the appellant by the

order of this Court in Collector of Central Excise, Baroda v. Indian Petro Chemi-

cals [1997 (92) E.L.T. 13]. Where there are two exemption notifications that

cover the goods in question, the assessee is entitled to the benefit of that ex-

emption notification which gives him greater relief, regardless of the fact

that that notification is general in its terms and the other notification is

more specific to the goods.

2. The civil appeals are allowed and the orders under appeal are set aside.

3. No order as to costs.’

9. Revenue also argues that that the writ petition is not maintainable in

the light of the fact that the impugned order is subject to a revision in terms of

Regulation 16 of the Foreign Trade (Development and Regulation Act), 1992.

However, since the issue arising for consideration is squarely covered by the

judgment of the Supreme Court (supra) followed consistently by this Court (see

Lenovo (India) Pvt. Ltd. v. Union of India [2017 (346) E.L.T. 12 (Mad.)], M/s. Agnice

EXCISE LAW TIMES 15th August 2020 138