Page 165 - ELT_15th August 2020_Vol 373_Part 4

P. 165

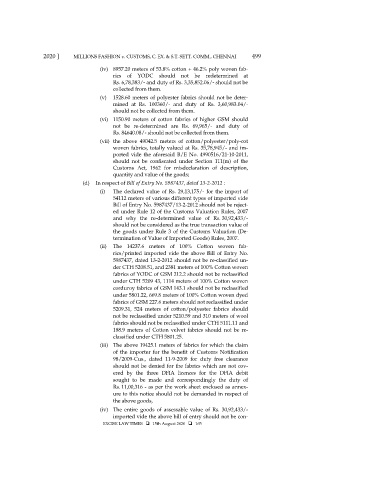

2020 ] MILLIONS FASHION v. CUSTOMS, C. EX. & S.T. SETT. COMM., CHENNAI 499

(iv) 8957.20 meters of 53.8% cotton + 46.2% poly woven fab-

rics of YODC should not be redetermined at

Rs. 6,78,383/- and duty of Rs. 3,35,852.06/- should not be

collected from them.

(v) 1528.60 meters of polyester fabrics should not be deter-

mined at Rs. 100360/- and duty of Rs. 3,60,983.04/-

should not be collected from them.

(vi) 1150.90 meters of cotton fabrics of higher GSM should

not be re-determined are Rs. 69,965/- and duty of

Rs. 84640.08/- should not be collected from them.

(vii) the above 49042.5 meters of cotton/polyester/poly-cot

woven fabrics, totally valued at Rs. 35,78,945/- and im-

ported vide the aforesaid B/E No. 4990516/21-10-2011,

should not be confiscated under Section 111(m) of the

Customs Act, 1962 for misdeclaration of description,

quantity and value of the goods;

(d) In respect of Bill of Entry No. 5987437, dated 13-2-2012 :

(i) The declared value of Rs. 29,13,175/- for the import of

54112 meters of various different types of imported vide

Bill of Entry No. 5987437/13-2-2012 should not be reject-

ed under Rule 12 of the Customs Valuation Rules, 2007

and why the re-determined value of Rs. 30,92,433/-

should not be considered as the true transaction value of

the goods under Rule 3 of the Customs Valuation (De-

termination of Value of Imported Goods) Rules, 2007.

(ii) The 14237.6 meters of 100% Cotton woven fab-

rics/printed imported vide the above Bill of Entry No.

5987437, dated 13-2-2012 should not be re-classified un-

der CTH 5208.51, and 2381 meters of 100% Cotton woven

fabrics of YODC of GSM 212.2 should not be reclassified

under CTH 5209 43, 1114 meters of 100% Cotton woven

corduroy fabrics of GSM 143.1 should not be reclassified

under 5801.22, 669.8 meters of 100% Cotton woven dyed

fabrics of GSM 227.6 meters should not reclassified under

5209.31, 524 meters of cotton/polyester fabrics should

not be reclassified under 5210.59 and 310 meters of wool

fabrics should not be reclassified under CTH 5111.11 and

188.9 meters of Cotton velvet fabrics should not be re-

classified under CTH 5801.25.

(iii) The above 19425.1 meters of fabrics for which the claim

of the importer for the benefit of Customs Notification

98/2009-Cus., dated 11-9-2009 for duty free clearance

should not be denied for the fabrics which are not cov-

ered by the three DFIA licences for the DFIA debit

sought to be made and correspondingly the duty of

Rs. 11,00,316 - as per the work sheet enclosed as annex-

ure to this notice should not be demanded in respect of

the above goods,

(iv) The entire goods of assessable value of Rs. 30,92,433/-

imported vide the above bill of entry should not be con-

EXCISE LAW TIMES 15th August 2020 165