Page 196 - ELT_15th August 2020_Vol 373_Part 4

P. 196

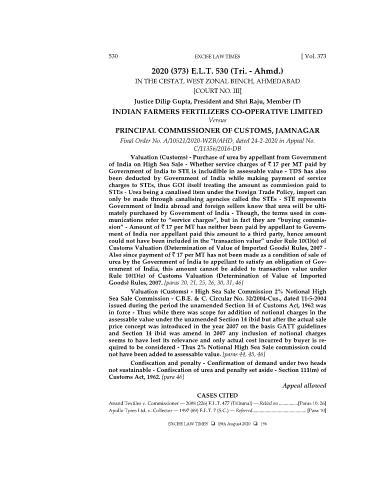

530 EXCISE LAW TIMES [ Vol. 373

2020 (373) E.L.T. 530 (Tri. - Ahmd.)

IN THE CESTAT, WEST ZONAL BENCH, AHMEDABAD

[COURT NO. III]

Justice Dilip Gupta, President and Shri Raju, Member (T)

IFFCO LTD.

INDIAN FARMERS FERTILIZERS CO-OPERATIVE LIMITED

IFFCO LTD.

Versus

PRINCIPAL COMMISSIONER OF CUSTOMS, JAMNAGAR

Final Order No. A/10521/2020-WZB/AHD, dated 24-2-2020 in Appeal No.

C/11356/2016-DB

Valuation (Customs) - Purchase of urea by appellant from Government

of India on High Sea Sale - Whether service charges of ` 17 per MT paid by

Government of India to STE is includible in assessable value - TDS has also

been deducted by Government of India while making payment of service

charges to STEs, thus GOI itself treating the amount as commission paid to

STEs - Urea being a canalised item under the Foreign Trade Policy, import can

only be made through canalising agencies called the STEs - STE represents

Government of India abroad and foreign sellers know that urea will be ulti-

mately purchased by Government of India - Though, the terms used in com-

munications refer to “service charges”, but in fact they are “buying commis-

sion” - Amount of ` 17 per MT has neither been paid by appellant to Govern-

ment of India nor appellant paid this amount to a third party, hence amount

could not have been included in the “transaction value” under Rule 10(1)(e) of

Customs Valuation (Determination of Value of Imported Goods) Rules, 2007 -

Also since payment of ` 17 per MT has not been made as a condition of sale of

urea by the Government of India to appellant to satisfy an obligation of Gov-

ernment of India, this amount cannot be added to transaction value under

Rule 10(1)(e) of Customs Valuation (Determination of Value of Imported

Goods) Rules, 2007. [paras 20, 21, 25, 26, 30, 31, 46]

Valuation (Customs) - High Sea Sale Commission 2% Notional High

Sea Sale Commission - C.B.E. & C. Circular No. 32/2004-Cus., dated 11-5-2004

issued during the period the unamended Section 14 of Customs Act, 1962 was

in force - Thus while there was scope for addition of notional charges in the

assessable value under the unamended Section 14 ibid but after the actual sale

price concept was introduced in the year 2007 on the basis GATT guidelines

and Section 14 ibid was amend in 2007 any inclusion of notional charges

seems to have lost its relevance and only actual cost incurred by buyer is re-

quired to be considered - Thus 2% Notional High Sea Sale commission could

not have been added to assessable value. [paras 44, 45, 46]

Confiscation and penalty - Confirmation of demand under two heads

not sustainable - Confiscation of urea and penalty set aside - Section 111(m) of

Customs Act, 1962. [para 46]

Appeal allowed

CASES CITED

Anand Textiles v. Commissioner — 2008 (226) E.L.T. 477 (Tribunal) — Relied on ................ [Paras 10, 26]

Apollo Tyres Ltd. v. Collector — 1997 (89) E.L.T. 7 (S.C.) — Referred ............................................. [Para 10]

EXCISE LAW TIMES 15th August 2020 196