Page 216 - ELT_15th August 2020_Vol 373_Part 4

P. 216

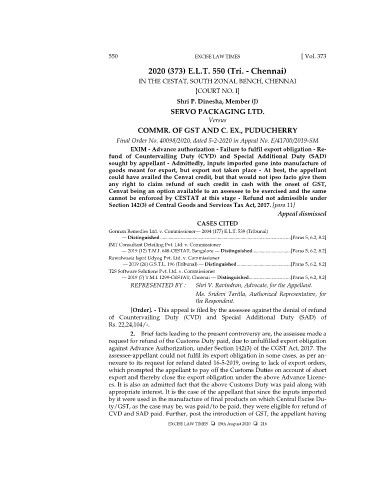

550 EXCISE LAW TIMES [ Vol. 373

2020 (373) E.L.T. 550 (Tri. - Chennai)

IN THE CESTAT, SOUTH ZONAL BENCH, CHENNAI

[COURT NO. I]

Shri P. Dinesha, Member (J)

SERVO PACKAGING LTD.

Versus

COMMR. OF GST AND C. EX., PUDUCHERRY

Final Order No. 40098/2020, dated 5-2-2020 in Appeal No. E/41700/2019-SM

EXIM - Advance authorization - Failure to fulfil export obligation - Re-

fund of Countervailing Duty (CVD) and Special Additional Duty (SAD)

sought by appellant - Admittedly, inputs imported gone into manufacture of

goods meant for export, but export not taken place - At best, the appellant

could have availed the Cenvat credit, but that would not ipso facto give them

any right to claim refund of such credit in cash with the onset of GST,

Cenvat being an option available to an assessee to be exercised and the same

cannot be enforced by CESTAT at this stage - Refund not admissible under

Section 142(3) of Central Goods and Services Tax Act, 2017. [para 11]

Appeal dismissed

CASES CITED

German Remedies Ltd. v. Commissioner— 2004 (177) E.L.T. 539 (Tribunal)

— Distinguished ............................................................................................................. [Paras 5, 6.2, 8.2]

JMT Consultant Detailing Pvt. Ltd. v. Commissioner

— 2019 (12) T.M.I. 648-CESTAT, Bangalore — Distinguished ................................ [Paras 5, 6.2, 8.2]

Rawalwasia Ispat Udyog Pvt. Ltd. v. Commissioner

— 2019 (26) G.S.T.L. 196 (Tribunal) — Distinguished ............................................. [Paras 5, 6.2, 8.2]

T2S Software Solutions Pvt. Ltd. v. Commissioner

— 2019 (7) T.M.I. 1299-CESTAT, Chennai — Distinguished ................................... [Paras 5, 6.2, 8.2]

REPRESENTED BY : Shri V. Ravindran, Advocate, for the Appellant.

Ms. Sridevi Taritla, Authorized Representative, for

the Respondent.

[Order]. - This appeal is filed by the assessee against the denial of refund

of Countervailing Duty (CVD) and Special Additional Duty (SAD) of

Rs. 22,24,104/-.

2. Brief facts leading to the present controversy are, the assessee made a

request for refund of the Customs Duty paid, due to unfulfilled export obligation

against Advance Authorization, under Section 142(3) of the CGST Act, 2017. The

assessee-appellant could not fulfil its export obligation in some cases, as per an-

nexure to its request for refund dated 16-5-2019, owing to lack of export orders,

which prompted the appellant to pay off the Customs Duties on account of short

export and thereby close the export obligation under the above Advance Licenc-

es. It is also an admitted fact that the above Customs Duty was paid along with

appropriate interest. It is the case of the appellant that since the inputs imported

by it were used in the manufacture of final products on which Central Excise Du-

ty/GST, as the case may be, was paid/to be paid, they were eligible for refund of

CVD and SAD paid. Further, post the introduction of GST, the appellant having

EXCISE LAW TIMES 15th August 2020 216