Page 230 - ELT_15th August 2020_Vol 373_Part 4

P. 230

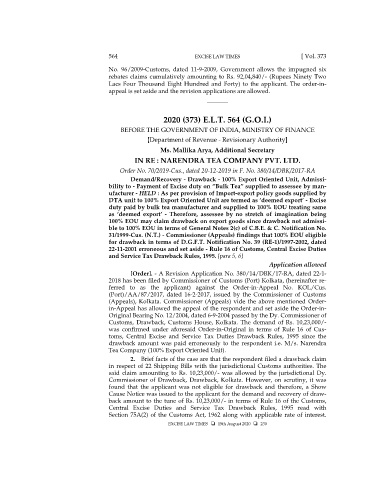

564 EXCISE LAW TIMES [ Vol. 373

No. 96/2009-Customs, dated 11-9-2009, Government allows the impugned six

rebates claims cumulatively amounting to Rs. 92,04,840/- (Rupees Ninety Two

Lacs Four Thousand Eight Hundred and Forty) to the applicant. The order-in-

appeal is set aside and the revision applications are allowed.

_______

2020 (373) E.L.T. 564 (G.O.I.)

BEFORE THE GOVERNMENT OF INDIA, MINISTRY OF FINANCE

[Department of Revenue - Revisionary Authority]

Ms. Mallika Arya, Additional Secretary

IN RE : NARENDRA TEA COMPANY PVT. LTD.

Order No. 70/2019-Cus., dated 20-12-2019 in F. No. 380/14/DBK/2017-RA

Demand/Recovery - Drawback - 100% Export Oriented Unit, Admissi-

bility to - Payment of Excise duty on “Bulk Tea” supplied to assessee by man-

ufacturer - HELD : As per provision of Import-export policy goods supplied by

DTA unit to 100% Export Oriented Unit are termed as ‘deemed export’ - Excise

duty paid by bulk tea manufacturer and supplied to 100% EOU treating same

as ‘deemed export’ - Therefore, assessee by no stretch of imagination being

100% EOU may claim drawback on export goods since drawback not admissi-

ble to 100% EOU in terms of General Notes 2(c) of C.B.E. & C. Notification No.

31/1999-Cus. (N.T.) - Commissioner (Appeals) findings that 100% EOU eligible

for drawback in terms of D.G.F.T. Notification No. 39 (RE-1)/1997-2002, dated

22-11-2001 erroneous and set aside - Rule 16 of Customs, Central Excise Duties

and Service Tax Drawback Rules, 1995. [para 5, 6]

Application allowed

[Order]. - A Revision Application No. 380/14/DBK/17-RA, dated 22-1-

2018 has been filed by Commissioner of Customs (Port) Kolkata, (hereinafter re-

ferred to as the applicant) against the Order-in-Appeal No. KOL/Cus.

(Port)/AA/87/2017, dated 16-2-2017, issued by the Commissioner of Customs

(Appeals), Kolkata. Commissioner (Appeals) vide the above mentioned Order-

in-Appeal has allowed the appeal of the respondent and set aside the Order-in-

Original Bearing No. 12/2004, dated 6-9-2004 passed by the Dy. Commissioner of

Customs, Drawback, Customs House, Kolkata. The demand of Rs. 10,23,000/-

was confirmed under aforesaid Order-in-Original in terms of Rule 16 of Cus-

toms, Central Excise and Service Tax Duties Drawback Rules, 1995 since the

drawback amount was paid erroneously to the respondent i.e. M/s. Narendra

Tea Company (100% Export Oriented Unit).

2. Brief facts of the case are that the respondent filed a drawback claim

in respect of 22 Shipping Bills with the jurisdictional Customs authorities. The

said claim amounting to Rs. 10,23,000/- was allowed by the jurisdictional Dy.

Commissioner of Drawback, Drawback, Kolkata. However, on scrutiny, it was

found that the applicant was not eligible for drawback and therefore, a Show

Cause Notice was issued to the applicant for the demand and recovery of draw-

back amount to the tune of Rs. 10,23,000/- in terms of Rule 16 of the Customs,

Central Excise Duties and Service Tax Drawback Rules, 1995 read with

Section 75A(2) of the Customs Act, 1962 along with applicable rate of interest.

EXCISE LAW TIMES 15th August 2020 230