Page 37 - ELT_15th August 2020_Vol 373_Part 4

P. 37

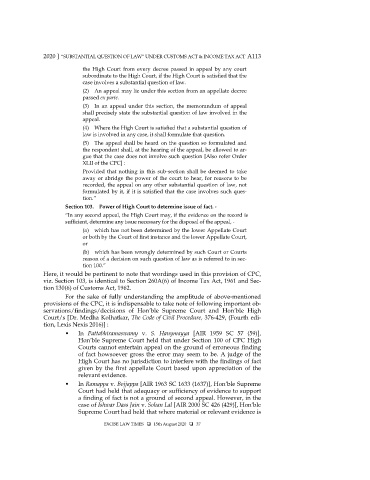

2020 ] “SUBSTANTIAL QUESTION OF LAW” UNDER CUSTOMS ACT & INCOME TAX ACT A113

the High Court from every decree passed in appeal by any court

subordinate to the High Court, if the High Court is satisfied that the

case involves a substantial question of law.

(2) An appeal may lie under this section from an appellate decree

passed ex parte.

(3) In an appeal under this section, the memorandum of appeal

shall precisely state the substantial question of law involved in the

appeal.

(4) Where the High Court is satisfied that a substantial question of

law is involved in any case, it shall formulate that question.

(5) The appeal shall be heard on the question so formulated and

the respondent shall, at the hearing of the appeal, be allowed to ar-

gue that the case does not involve such question [Also refer Order

XLII of the CPC] :

Provided that nothing in this sub-section shall be deemed to take

away or abridge the power of the court to hear, for reasons to be

recorded, the appeal on any other substantial question of law, not

formulated by it, if it is satisfied that the case involves such ques-

tion.”

Section 103. Power of High Court to determine issue of fact. -

“In any second appeal, the High Court may, if the evidence on the record is

sufficient, determine any issue necessary for the disposal of the appeal, -

(a) which has not been determined by the lower Appellate Court

or both by the Court of first instance and the lower Appellate Court,

or

(b) which has been wrongly determined by such Court or Courts

reason of a decision on such question of law as is referred to in sec-

tion 100.”

Here, it would be pertinent to note that wordings used in this provision of CPC,

viz. Section 103, is identical to Section 260A(6) of Income Tax Act, 1961 and Sec-

tion 130(6) of Customs Act, 1962.

For the sake of fully understanding the amplitude of above-mentioned

provisions of the CPC, it is indispensable to take note of following important ob-

servations/findings/decisions of Hon’ble Supreme Court and Hon’ble High

Court/s [Dr. Medha Kolhatkar, The Code of Civil Procedure, 376-429, (Fourth edi-

tion, Lexis Nexis 2016)] :

• In Pattabhiramaswamy v. S. Hanymayya [AIR 1959 SC 57 (59)],

Hon’ble Supreme Court held that under Section 100 of CPC High

Courts cannot entertain appeal on the ground of erroneous finding

of fact howsoever gross the error may seem to be. A judge of the

High Court has no jurisdiction to interfere with the findings of fact

given by the first appellate Court based upon appreciation of the

relevant evidence.

• In Ramappa v. Bojjappa [AIR 1963 SC 1633 (1637)], Hon’ble Supreme

Court had held that adequacy or sufficiency of evidence to support

a finding of fact is not a ground of second appeal. However, in the

case of Ishwar Dass Jain v. Sohan Lal [AIR 2000 SC 426 (429)], Hon’ble

Supreme Court had held that where material or relevant evidence is

EXCISE LAW TIMES 15th August 2020 37