Page 75 - ELT_15th August 2020_Vol 373_Part 4

P. 75

2020 ] NOTIFICATIONS N63

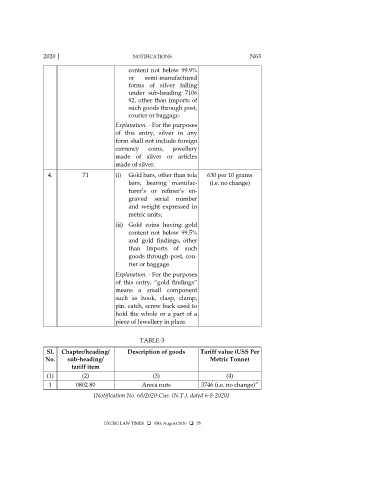

content not below 99.9%

or semi-manufactured

forms of silver falling

under sub-heading 7106

92, other than imports of

such goods through post,

courier or baggage.

Explanation. - For the purposes

of this entry, silver in any

form shall not include foreign

currency coins, jewellery

made of silver or articles

made of silver.

4. 71 (i) Gold bars, other than tola 630 per 10 grams

bars, bearing manufac- (i.e. no change)

turer’s or refiner’s en-

graved serial number

and weight expressed in

metric units;

(ii) Gold coins having gold

content not below 99.5%

and gold findings, other

than imports of such

goods through post, cou-

rier or baggage.

Explanation. - For the purposes

of this entry, “gold findings”

means a small component

such as hook, clasp, clamp,

pin, catch, screw back used to

hold the whole or a part of a

piece of Jewellery in place.

TABLE-3

Sl. Chapter/heading/ Description of goods Tariff value (USS Per

No. sub-heading/ Metric Tonne)

tariff item

(1) (2) (3) (4)

1 0802 80 Areca nuts 3746 (i.e. no change)”

[Notification No. 68/2020-Cus. (N.T.), dated 6-8-2020]

EXCISE LAW TIMES 15th August 2020 75