Page 127 - GSTL_16 April 2020_Vol 35_Part 3

P. 127

2020 ] IN RE : PADMAVATHI HOSPITALITY & FACILITIES MANAGEMENT SERVICE 341

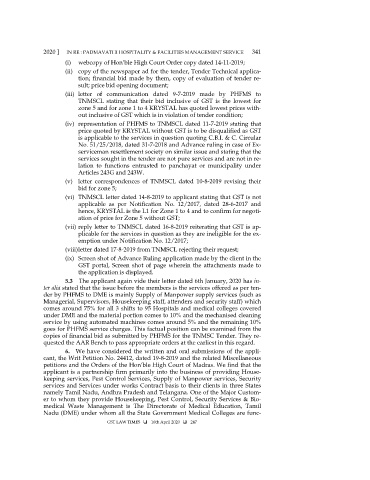

(i) webcopy of Hon’ble High Court Order copy dated 14-11-2019;

(ii) copy of the newspaper ad for the tender, Tender Technical applica-

tion; financial bid made by them, copy of evaluation of tender re-

sult; price bid opening document;

(iii) letter of communication dated 9-7-2019 made by PHFMS to

TNMSCL stating that their bid inclusive of GST is the lowest for

zone 5 and for zone 1 to 4 KRYSTAL has quoted lowest prices with-

out inclusive of GST which is in violation of tender condition;

(iv) representation of PHFMS to TNMSCL dated 11-7-2019 stating that

price quoted by KRYSTAL without GST is to be disqualified as GST

is applicable to the services in question quoting C.B.I. & C. Circular

No. 51/25/2018, dated 31-7-2018 and Advance ruling in case of Ex-

serviceman resettlement society on similar issue and stating that the

services sought in the tender are not pure services and are not in re-

lation to functions entrusted to panchayat or municipality under

Articles 243G and 243W.

(v) letter correspondences of TNMSCL dated 10-8-2019 revising their

bid for zone 5;

(vi) TNMSCL letter dated 14-8-2019 to applicant stating that GST is not

applicable as per Notification No. 12/2017, dated 28-6-2017 and

hence, KRYSTAL is the L1 for Zone 1 to 4 and to confirm for negoti-

ation of price for Zone 5 without GST;

(vii) reply letter to TNMSCL dated 16-8-2019 reiterating that GST is ap-

plicable for the services in question as they are ineligible for the ex-

emption under Notification No. 12/2017;

(viii) letter dated 17-8-2019 from TNMSCL rejecting their request;

(ix) Screen shot of Advance Ruling application made by the client in the

GST portal, Screen shot of page wherein the attachments made to

the application is displayed.

5.3 The applicant again vide their letter dated 6th January, 2020 has in-

ter alia stated that the issue before the members is the services offered as per ten-

der by PHFMS to DME is mainly Supply of Manpower supply services (such as

Managerial, Supervisors, Housekeeping staff, attenders and security staff) which

comes around 75% for all 3 shifts to 95 Hospitals and medical colleges covered

under DME and the material portion comes to 10% and the mechanised cleaning

service by using automated machines comes around 5% and the remaining 10%

goes for PHFMS service charges. This factual position can be examined from the

copies of financial bid as submitted by PHFMS for the TNMSC Tender. They re-

quested the AAR Bench to pass appropriate orders at the earliest in this regard.

6. We have considered the written and oral submissions of the appli-

cant, the Writ Petition No. 24412, dated 19-8-2019 and the related Miscellaneous

petitions and the Orders of the Hon’ble High Court of Madras. We find that the

applicant is a partnership firm primarily into the business of providing House-

keeping services, Pest Control Services, Supply of Manpower services, Security

services and Services under works Contract basis to their clients in three States

namely Tamil Nadu, Andhra Pradesh and Telangana. One of the Major Custom-

er to whom they provide Housekeeping, Pest Control, Security Services & Bio-

medical Waste Management is The Directorate of Medical Education, Tamil

Nadu (DME) under whom all the State Government Medical Colleges are func-

GST LAW TIMES 16th April 2020 247