Page 149 - GSTL_16 April 2020_Vol 35_Part 3

P. 149

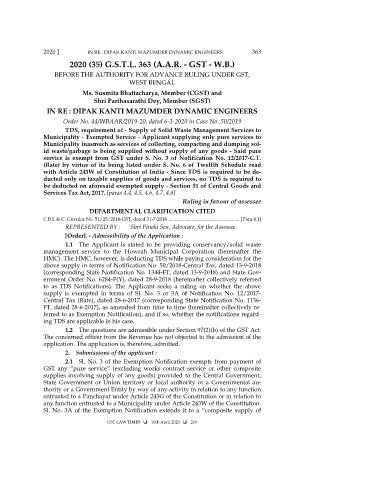

2020 ] IN RE : DIPAK KANTI MAZUMDER DYNAMIC ENGINEERS 363

2020 (35) G.S.T.L. 363 (A.A.R. - GST - W.B.)

BEFORE THE AUTHORITY FOR ADVANCE RULING UNDER GST,

WEST BENGAL

Ms. Susmita Bhattacharya, Member (CGST) and

Shri Parthasarathi Dey, Member (SGST)

IN RE : DIPAK KANTI MAZUMDER DYNAMIC ENGINEERS

Order No. 44/WBAAR/2019-20, dated 6-3-2020 in Case No. 50/2019

TDS, requirement of - Supply of Solid Waste Management Services to

Municipality - Exempted Service - Applicant supplying only pure services to

Municipality inasmuch as services of collecting, compacting and dumping sol-

id waste/garbage is being supplied without supply of any goods - Said pure

service is exempt from GST under S. No. 3 of Notification No. 12/2017-C.T.

(Rate) by virtue of its being listed under S. No. 6 of Twelfth Schedule read

with Article 243W of Constitution of India - Since TDS is required to be de-

ducted only on taxable supplies of goods and services, no TDS is required to

be deducted on aforesaid exempted supply - Section 51 of Central Goods and

Services Tax Act, 2017. [paras 4.4, 4.5, 4.6, 4.7, 4.8]

Ruling in favour of assessee

DEPARTMENTAL CLARIFICATION CITED

C.B.I. & C. Circular No. 51/25/2018-GST, dated 31-7-2018 ............................................................. [Para 4.1]

REPRESENTED BY : Shri Pinaki Sen, Advocate, for the Assessee.

[Order]. - Admissibility of the Application :

1.1 The Applicant is stated to be providing conservancy/solid waste

management service to the Howrah Municipal Corporation (hereinafter the

HMC). The HMC, however, is deducting TDS while paying consideration for the

above supply in terms of Notification No. 50/2018-Central Tax, dated 13-9-2018

(corresponding State Notification No. 1344-FT, dated 13-9-2018) and State Gov-

ernment Order No. 6284-F(Y), dated 28-9-2018 (hereinafter collectively referred

to as TDS Notifications). The Applicant seeks a ruling on whether the above

supply is exempted in terms of Sl. No. 3 or 3A of Notification No. 12/2017-

Central Tax (Rate), dated 28-6-2017 (corresponding State Notification No. 1136-

FT, dated 28-6-2017), as amended from time to time (hereinafter collectively re-

ferred to as Exemption Notification), and if so, whether the notifications regard-

ing TDS are applicable in his case.

1.2 The questions are admissible under Section 97(2)(b) of the GST Act.

The concerned officer from the Revenue has not objected to the admission of the

application. The application is, therefore, admitted.

2. Submissions of the applicant :

2.1 Sl. No. 3 of the Exemption Notification exempts from payment of

GST any “pure service” (excluding works contract service or other composite

supplies involving supply of any goods) provided to the Central Government,

State Government or Union territory or local authority or a Governmental au-

thority or a Government Entity by way of any activity in relation to any function

entrusted to a Panchayat under Article 243G of the Constitution or in relation to

any function entrusted to a Municipality under Article 243W of the Constitution.

Sl. No. 3A of the Exemption Notification extends it to a “composite supply of

GST LAW TIMES 16th April 2020 269