Page 17 - GSTL_16 April 2020_Vol 35_Part 3

P. 17

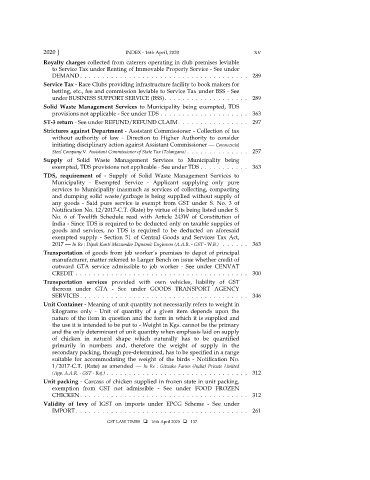

2020 ] INDEX - 16th April, 2020 xv

Royalty charges collected from caterers operating in club premises leviable

to Service Tax under Renting of Immovable Property Service - See under

DEMAND ...................................... 289

Service Tax - Race Clubs providing infrastructure facility to book makers for

betting, etc., fee and commission leviable to Service Tax under BSS - See

under BUSINESS SUPPORT SERVICE (BSS) ................... 289

Solid Waste Management Services to Municipality being exempted, TDS

provisions not applicable - See under TDS .................... 363

ST-3 return - See under REFUND/REFUND CLAIM ................ 297

Strictures against Department - Assistant Commissioner - Collection of tax

without authority of law - Direction to Higher Authority to consider

initiating disciplinary action against Assistant Commissioner — Commercial

Steel Company v. Assistant Commissioner of State Tax (Telangana) .............. 257

Supply of Solid Waste Management Services to Municipality being

exempted, TDS provisions not applicable - See under TDS ........... 363

TDS, requirement of - Supply of Solid Waste Management Services to

Municipality - Exempted Service - Applicant supplying only pure

services to Municipality inasmuch as services of collecting, compacting

and dumping solid waste/garbage is being supplied without supply of

any goods - Said pure service is exempt from GST under S. No. 3 of

Notification No. 12/2017-C.T. (Rate) by virtue of its being listed under S.

No. 6 of Twelfth Schedule read with Article 243W of Constitution of

India - Since TDS is required to be deducted only on taxable supplies of

goods and services, no TDS is required to be deducted on aforesaid

exempted supply - Section 51 of Central Goods and Services Tax Act,

2017 — In Re : Dipak Kanti Mazumder Dynamic Engineers (A.A.R. - GST - W.B.) ...... 363

Transportation of goods from job worker’s premises to depot of principal

manufacturer, matter referred to Larger Bench on issue whether credit of

outward GTA service admissible to job worker - See under CENVAT

CREDIT ....................................... 300

Transportation services provided with own vehicles, liability of GST

thereon under GTA - See under GOODS TRANSPORT AGENCY

SERVICES ...................................... 346

Unit Container - Meaning of unit quantity not necessarily refers to weight in

kilograms only - Unit of quantity of a given item depends upon the

nature of the item in question and the form in which it is supplied and

the use it is intended to be put to - Weight in Kgs. cannot be the primary

and the only determinant of unit quantity when emphasis laid on supply

of chicken in natural shape which naturally has to be quantified

primarily in numbers and, therefore the weight of supply in the

secondary packing, though pre-determined, has to be specified in a range

suitable for accommodating the weight of the birds - Notification No.

1/2017-C.T. (Rate) as amended — In Re : Gitwako Farms (India) Private Limited

(App. A.A.R. - GST - Raj.) ................................ 312

Unit packing - Carcass of chicken supplied in frozen state in unit packing,

exemption from GST not admissible - See under FOOD FROZEN

CHICKEN ...................................... 312

Validity of levy of IGST on imports under EPCG Scheme - See under

IMPORT ....................................... 261

GST LAW TIMES 16th April 2020 137