Page 199 - GSTL_14th May 2020_Vol 36_Part 2

P. 199

2020 ] IN RE : HINDUSTAN COCA-COLA BEVERAGES PVT. LTD. 301

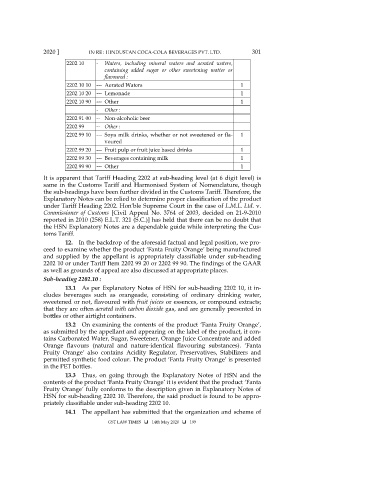

2202 10 - Waters, including mineral waters and aerated waters,

containing added sugar or other sweetening matter or

flavoured :

2202 10 10 --- Aerated Waters 1

2202 10 20 --- Lemonade 1

2202 10 90 --- Other 1

- Other :

2202 91 00 -- Non-alcoholic beer

2202 99 -- Other :

2202 99 10 --- Soya milk drinks, whether or not sweetened or fla- 1

voured

2202 99 20 --- Fruit pulp or fruit juice based drinks 1

2202 99 30 --- Beverages containing milk 1

2202 99 90 --- Other 1

It is apparent that Tariff Heading 2202 at sub-heading level (at 6 digit level) is

same in the Customs Tariff and Harmonised System of Nomenclature, though

the sub-headings have been further divided in the Customs Tariff. Therefore, the

Explanatory Notes can be relied to determine proper classification of the product

under Tariff Heading 2202. Hon’ble Supreme Court in the case of L.M.L. Ltd. v.

Commissioner of Customs [Civil Appeal No. 3764 of 2003, decided on 21-9-2010

reported in 2010 (258) E.L.T. 321 (S.C.)] has held that there can be no doubt that

the HSN Explanatory Notes are a dependable guide while interpreting the Cus-

toms Tariff.

12. In the backdrop of the aforesaid factual and legal position, we pro-

ceed to examine whether the product ‘Fanta Fruity Orange’ being manufactured

and supplied by the appellant is appropriately classifiable under sub-heading

2202 10 or under Tariff Item 2202 99 20 or 2202 99 90. The findings of the GAAR

as well as grounds of appeal are also discussed at appropriate places.

Sub-heading 2202.10 :

13.1 As per Explanatory Notes of HSN for sub-heading 2202 10, it in-

cludes beverages such as orangeade, consisting of ordinary drinking water,

sweetened or not, flavoured with fruit juices or essences, or compound extracts;

that they are often aerated with carbon dioxide gas, and are generally presented in

bottles or other airtight containers.

13.2 On examining the contents of the product ‘Fanta Fruity Orange’,

as submitted by the appellant and appearing on the label of the product, it con-

tains Carbonated Water, Sugar, Sweetener, Orange Juice Concentrate and added

Orange flavours (natural and nature-identical flavouring substances). ‘Fanta

Fruity Orange’ also contains Acidity Regulator, Preservatives, Stabilizers and

permitted synthetic food colour. The product ‘Fanta Fruity Orange’ is presented

in the PET bottles.

13.3 Thus, on going through the Explanatory Notes of HSN and the

contents of the product ‘Fanta Fruity Orange’ it is evident that the product ‘Fanta

Fruity Orange’ fully conforms to the description given in Explanatory Notes of

HSN for sub-heading 2202 10. Therefore, the said product is found to be appro-

priately classifiable under sub-heading 2202 10.

14.1 The appellant has submitted that the organization and scheme of

GST LAW TIMES 14th May 2020 199