Page 23 - GSTL_14th May 2020_Vol 36_Part 2

P. 23

2020 ] GST RETURNS — VERSION 2.0 (INTRICACIES AND REPORTING CHANGES) J23

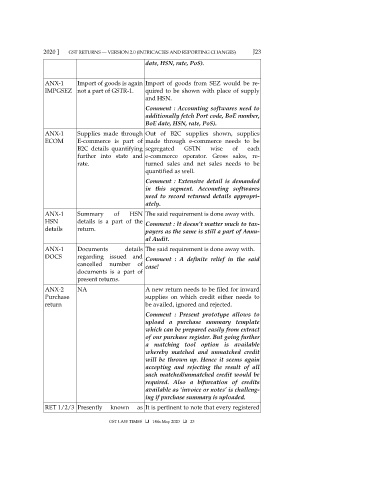

date, HSN, rate, PoS).

ANX-1 Import of goods is again Import of goods from SEZ would be re-

IMPGSEZ not a part of GSTR-1. quired to be shown with place of supply

and HSN.

Comment : Accounting softwares need to

additionally fetch Port code, BoE number,

BoE date, HSN, rate, PoS).

ANX-1 Supplies made through Out of B2C supplies shown, supplies

ECOM E-commerce is part of made through e-commerce needs to be

B2C details quantifying segregated GSTN wise of each

further into state and e-commerce operator. Gross sales, re-

rate. turned sales and net sales needs to be

quantified as well.

Comment : Extensive detail is demanded

in this segment. Accounting softwares

need to record returned details appropri-

ately.

ANX-1 Summary of HSN The said requirement is done away with.

HSN details is a part of the Comment : It doesn’t matter much to tax-

details return. payers as the same is still a part of Annu-

al Audit.

ANX-1 Documents details The said requirement is done away with.

DOCS regarding issued and Comment : A definite relief in the said

cancelled number of case!

documents is a part of

present returns.

ANX-2 NA A new return needs to be filed for inward

Purchase supplies on which credit either needs to

return be availed, ignored and rejected.

Comment : Present prototype allows to

upload a purchase summary template

which can be prepared easily from extract

of our purchase register. But going further

a matching tool option is available

whereby matched and unmatched credit

will be thrown up. Hence it seems again

accepting and rejecting the result of all

such matched/unmatched credit would be

required. Also a bifurcation of credits

available as ‘invoice or notes’ is challeng-

ing if purchase summary is uploaded.

RET 1/2/3 Presently known as It is pertinent to note that every registered

GST LAW TIMES 14th May 2020 23