Page 29 - GSTL_14th May 2020_Vol 36_Part 2

P. 29

2020 ] INHUMANE LEVY OF GST ON EQUIPMENTS & AIDS OF DISABLED J29

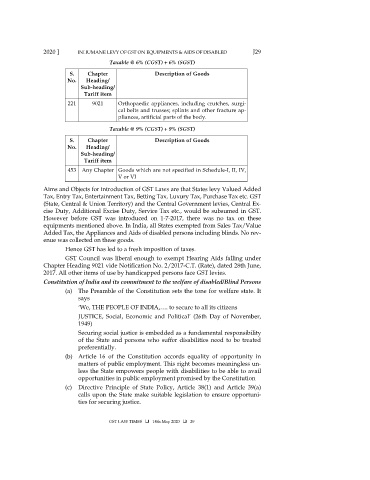

Taxable @ 6% (CGST) + 6% (SGST)

S. Chapter Description of Goods

No. Heading/

Sub-heading/

Tariff item

221 9021 Orthopaedic appliances, including crutches, surgi-

cal belts and trusses; splints and other fracture ap-

pliances, artificial parts of the body.

Taxable @ 9% (CGST) + 9% (SGST)

S. Chapter Description of Goods

No. Heading/

Sub-heading/

Tariff item

453 Any Chapter Goods which are not specified in Schedule-I, II, IV,

V or VI

Aims and Objects for introduction of GST Laws are that States levy Valued Added

Tax, Entry Tax, Entertainment Tax, Betting Tax, Luxury Tax, Purchase Tax etc. GST

(State, Central & Union Territory) and the Central Government levies, Central Ex-

cise Duty, Additional Excise Duty, Service Tax etc., would be subsumed in GST.

However before GST was introduced on 1-7-2017, there was no tax on these

equipments mentioned above. In India, all States exempted from Sales Tax/Value

Added Tax, the Appliances and Aids of disabled persons including blinds. No rev-

enue was collected on these goods.

Hence GST has led to a fresh imposition of taxes.

GST Council was liberal enough to exempt Hearing Aids falling under

Chapter Heading 9021 vide Notification No. 2/2017-C.T. (Rate), dated 28th June,

2017. All other items of use by handicapped persons face GST levies.

Constitution of India and its commitment to the welfare of disabled/Blind Persons

(a) The Preamble of the Constitution sets the tone for welfare state. It

says

‘We, THE PEOPLE OF INDIA,…. to secure to all its citizens

JUSTICE, Social, Economic and Political’ (26th Day of November,

1949)

Securing social justice is embedded as a fundamental responsibility

of the State and persons who suffer disabilities need to be treated

preferentially.

(b) Article 16 of the Constitution accords equality of opportunity in

matters of public employment. This right becomes meaningless un-

less the State empowers people with disabilities to be able to avail

opportunities in public employment promised by the Constitution

(c) Directive Principle of State Policy, Article 38(1) and Article 39(a)

calls upon the State make suitable legislation to ensure opportuni-

ties for securing justice.

GST LAW TIMES 14th May 2020 29