Page 43 - GSTL_14th May 2020_Vol 36_Part 2

P. 43

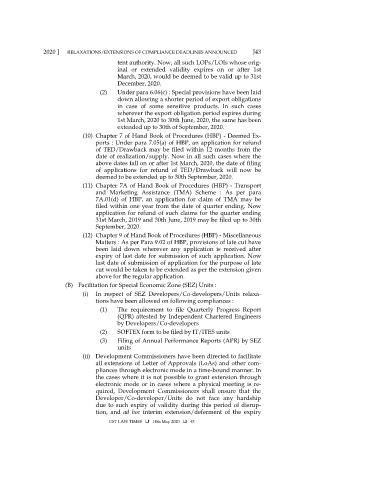

2020 ] RELAXATIONS/EXTENSIONS OF COMPLIANCE DEADLINES ANNOUNCED J43

tent authority. Now, all such LOPs/LOIs whose orig-

inal or extended validity expires on or after 1st

March, 2020, would be deemed to be valid up to 31st

December, 2020.

(2) Under para 6.06(c) : Special provisions have been laid

down allowing a shorter period of export obligations

in case of some sensitive products. In such cases

wherever the export obligation period expires during

1st March, 2020 to 30th June, 2020, the same has been

extended up to 30th of September, 2020.

(10) Chapter 7 of Hand Book of Procedures (HBP) - Deemed Ex-

ports : Under para 7.05(a) of HBP, an application for refund

of TED/Drawback may be filed within 12 months from the

date of realization/supply. Now in all such cases where the

above dates fall on or after 1st March, 2020, the date of filing

of applications for refund of TED/Drawback will now be

deemed to be extended up to 30th September, 2020.

(11) Chapter 7A of Hand Book of Procedures (HBP) - Transport

and Marketing Assistance (TMA) Scheme : As per para

7A.01(d) of HBP, an application for claim of TMA may be

filed within one year from the date of quarter ending. Now

application for refund of such claims for the quarter ending

31st March, 2019 and 30th June, 2019 may be filed up to 30th

September, 2020.

(12) Chapter 9 of Hand Book of Procedures (HBP) - Miscellaneous

Matters : As per Para 9.02 of HBP, provisions of late cut have

been laid down wherever any application is received after

expiry of last date for submission of such application. Now

last date of submission of application for the purpose of late

cut would be taken to be extended as per the extension given

above for the regular application.

(B) Facilitation for Special Economic Zone (SEZ) Units :

(i) In respect of SEZ Developers/Co-developers/Units relaxa-

tions have been allowed on following compliances :

(1) The requirement to file Quarterly Progress Report

(QPR) attested by Independent Chartered Engineers

by Developers/Co‐developers

(2) SOFTEX form to be filed by IT/ITES units

(3) Filing of Annual Performance Reports (APR) by SEZ

units

(ii) Development Commissioners have been directed to facilitate

all extensions of Letter of Approvals (LoAs) and other com-

pliances through electronic mode in a time‐bound manner. In

the cases where it is not possible to grant extension through

electronic mode or in cases where a physical meeting is re-

quired, Development Commissioners shall ensure that the

Developer/Co‐developer/Units do not face any hardship

due to such expiry of validity during this period of disrup-

tion, and ad hoc interim extension/deferment of the expiry

GST LAW TIMES 14th May 2020 43