Page 169 - GSTL_21st May 2020_Vol 36_Part 3

P. 169

2020 ] IN RE : SOLIZE INDIA TECHNOLOGIES PVT. LTD. 415

fied to cover them under the definition of “goods”. Further, the goods which are

supplied by the applicant cannot be used without the aid of the computer and

has to be loaded on a computer and then after activation, would become usable

and hence the goods supplied is “computer software” and more specifically cov-

ered under “Application Software”. Hence the supply made by the applicant is

covered under “supply of goods” and the goods supplied are covered under the

HSN 8523.

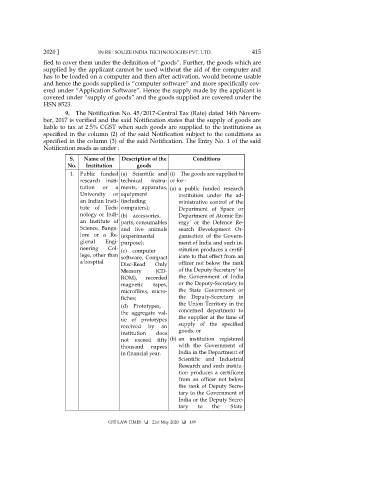

9. The Notification No. 45/2017-Central Tax (Rate) dated 14th Novem-

ber, 2017 is verified and the said Notification states that the supply of goods are

liable to tax at 2.5% CGST when such goods are supplied to the institutions as

specified in the column (2) of the said Notification subject to the conditions as

specified in the column (3) of the said Notification. The Entry No. 1 of the said

Notification reads as under :

S. Name of the Description of the Conditions

No. Institution goods

1. Public funded (a) Scientific and (i) The goods are supplied to

research insti- technical instru- or for -

tution or a ments, apparatus, (a) a public funded research

University or equipment institution under the ad-

an Indian Insti- (including ministrative control of the

tute of Tech- computers); Department of Space or

nology or Indi- (b) accessories, Department of Atomic En-

an Institute of parts, consumables ergy’ or the Defence Re-

Science, Banga- and live animals search Development Or-

lore or a Re- (experimental ganisation of the Govern-

gional Engi- purpose); ment of India and such in-

neering Col- (c) computer stitution produces a certif-

lege, other than software, Compact icate to that effect from an

a hospital Disc-Read Only officer not below the rank

Memory (CD- of the Deputy Secretary’ to

ROM), recorded the Government of India

magnetic tapes, or the Deputy-Secretary to

microfilms, micro- the State Government or

fiches; the Deputy-Secretary in

(d) Prototypes, the Union Territory in the

the aggregate val- concerned department to

ue of prototypes the supplier at the time of

received by an supply of the specified

institution does goods; or

not exceed fifty (b) an institution registered

thousand rupees with the Government of

in financial year. India in the Department of

Scientific and Industrial

Research and such institu-

tion produces a certificate

from an officer not below

the rank of Deputy Secre-

tary to the Government of

India or the Deputy Secre-

tary to the State

GST LAW TIMES 21st May 2020 169