Page 197 - GSTL_21st May 2020_Vol 36_Part 3

P. 197

2020 ] IN RE : SRI MALAI MAHADESHWARA SWAMY KSHETHRA 443

2017 and therefore is exempted from the payment of GST on the same. In case, if

the rent is more than Rs. 10,000-00 per month, the same would be liable to tax at

9% CGST under SAC 9972 under Entry No. 16 of Notification No. 11/2017-

Central Tax (Rate), dated 28-6-2017.

12. The question in No. 9 related to the provision of services of Kalyana

Mandapam by the applicant, the Entry No. 13 of Notification No. 12/2017-

Central Tax (Rate), dated 28-6-2017 is verified. The applicant being a charitable

trust under Section 12AA of the Income-tax Act, 1961 is renting the Kalyana-

mandapam where the charges are less than Rs. 10,000-00 per day and hence the

same is covered under this entry and hence is exempt from the levy of CGST.

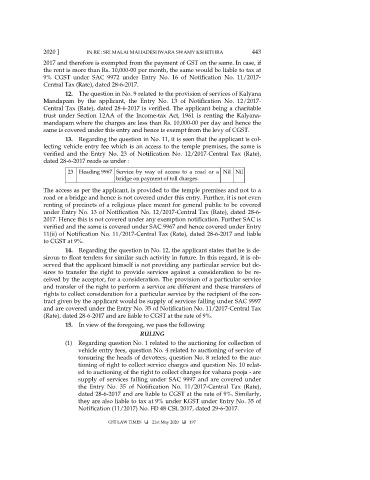

13. Regarding the question in No. 11, it is seen that the applicant is col-

lecting vehicle entry fee which is an access to the temple premises, the same is

verified and the Entry No. 23 of Notification No. 12/2017-Central Tax (Rate),

dated 28-6-2017 reads as under :

23 Heading 9967 Service by way of access to a road or a Nil Nil

bridge on payment of toll charges.

The access as per the applicant, is provided to the temple premises and not to a

road or a bridge and hence is not covered under this entry. Further, it is not even

renting of precincts of a religious place meant for general public to be covered

under Entry No. 13 of Notification No. 12/2017-Central Tax (Rate), dated 28-6-

2017. Hence this is not covered under any exemption notification. Further SAC is

verified and the same is covered under SAC 9967 and hence covered under Entry

11(ii) of Notification No. 11/2017-Central Tax (Rate), dated 28-6-2017 and liable

to CGST at 9%.

14. Regarding the question in No. 12, the applicant states that he is de-

sirous to float tenders for similar such activity in future. In this regard, it is ob-

served that the applicant himself is not providing any particular service but de-

sires to transfer the right to provide services against a consideration to be re-

ceived by the acceptor, for a consideration. The provision of a particular service

and transfer of the right to perform a service are different and these transfers of

rights to collect consideration for a particular service by the recipient of the con-

tract given by the applicant would be supply of services falling under SAC 9997

and are covered under the Entry No. 35 of Notification No. 11/2017-Central Tax

(Rate), dated 28-6-2017 and are liable to CGST at the rate of 9%.

15. In view of the foregoing, we pass the following

RULING

(1) Regarding question No. 1 related to the auctioning for collection of

vehicle entry fees, question No. 4 related to auctioning of service of

tonsuring the heads of devotees, question No. 8 related to the auc-

tioning of right to collect service charges and question No. 10 relat-

ed to auctioning of the right to collect charges for vahana pooja - are

supply of services falling under SAC 9997 and are covered under

the Entry No. 35 of Notification No. 11/2017-Central Tax (Rate),

dated 28-6-2017 and are liable to CGST at the rate of 9%. Similarly,

they are also liable to tax at 9% under KGST under Entry No. 35 of

Notification (11/2017) No. FD 48 CSL 2017, dated 29-6-2017.

GST LAW TIMES 21st May 2020 197