Page 42 - GSTL_21st May 2020_Vol 36_Part 3

P. 42

J68 GST LAW TIMES [ Vol. 36

dealer it would become its fixed asset. It’s the call of the dealer

on whether to dispose of the car in short or long span of time but

the car would be considered to be old or used vehicle.

(1.9) Without prejudice to supra mentioned legal provisions and

analysis of facts, inference need to place on judgment of Hon’ble

Delhi High Court passed in erstwhile VAT laws, in matters of

“Triumph Motors [A Unit of Khushi Traders (P.) Ltd.] v. Commis-

sioner of Value Added Tax - VAT Appeal No. 1 of 2016, dated 2nd

May, 2017” wherein it was held that “where assessee, a trader

dealing in cars, purchased a car and did not avail input tax credit on

purchase of said car; and, later it sold said car after using it as

demo car for several months, sale of car was exempt from tax un-

der Section 6(3) under DVAT Act, 2004”.

(1.10) In the said judgment Hon’ble High Court has clearly mentioned

car for demo purpose used and sold later would be covered un-

der Section 6(3) of DVAT Act, 2004 which states that “Section 6(3)

where a dealer sells capital goods which he has used since the time of

purchase exclusively for purposes other than making non-taxed sale of

goods, and has not claimed a tax credit in respect of such capital goods

under Section 9, the sale of such capital goods shall be exempt from

tax”.

(1.11) It is clearly evident on combined reading of the judgment, provi-

sions of DVAT Act that car used for demo purpose is old or used

vehicle on which no tax shall be levied subject to fulfilment of

the condition mentioned in Section 6(3) of DVAT Act, 2004 and

no ITC taken on the same.

(1.12) Thus based on above facts, legal provision and judicial pronouncement,

it can be said that the instant supply shall be classified as sale of old

and used vehicles and accordingly the taxability shall be determined in

respect of the same.

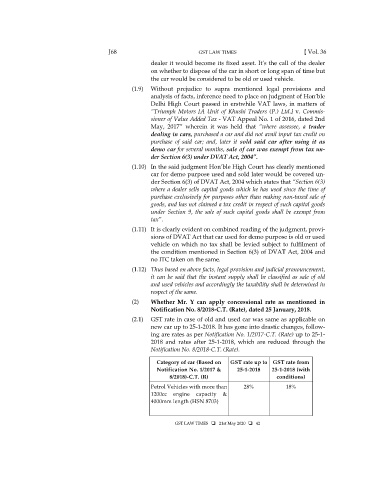

(2) Whether Mr. Y can apply concessional rate as mentioned in

Notification No. 8/2018-C.T. (Rate), dated 25 January, 2018.

(2.1) GST rate in case of old and used car was same as applicable on

new car up to 25-1-2018. It has gone into drastic changes, follow-

ing are rates as per Notification No. 1/2017-C.T. (Rate) up to 25-1-

2018 and rates after 25-1-2018, which are reduced through the

Notification No. 8/2018-C.T. (Rate).

Category of car (Based on GST rate up to GST rate from

Notification No. 1/2017 & 25-1-2018 25-1-2018 (with

8/2018)-C.T. (R) conditions)

Petrol Vehicles with more than 28% 18%

1200cc engine capacity &

4000mm length (HSN 8703)

GST LAW TIMES 21st May 2020 42