Page 31 - GSTL_ 28th May 2020_Vol 36_Part 4

P. 31

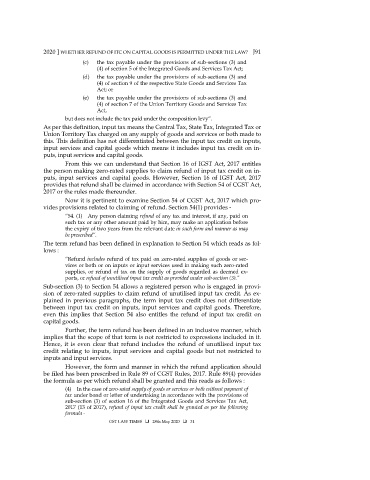

2020 ] WHETHER REFUND OF ITC ON CAPITAL GOODS IS PERMITTED UNDER THE LAW? J91

(c) the tax payable under the provisions of sub-sections (3) and

(4) of section 5 of the Integrated Goods and Services Tax Act;

(d) the tax payable under the provisions of sub-sections (3) and

(4) of section 9 of the respective State Goods and Services Tax

Act; or

(e) the tax payable under the provisions of sub-sections (3) and

(4) of section 7 of the Union Territory Goods and Services Tax

Act,

but does not include the tax paid under the composition levy”.

As per this definition, input tax means the Central Tax, State Tax, Integrated Tax or

Union Territory Tax charged on any supply of goods and services or both made to

this. This definition has not differentiated between the input tax credit on inputs,

input services and capital goods which means it includes input tax credit on in-

puts, input services and capital goods.

From this we can understand that Section 16 of IGST Act, 2017 entitles

the person making zero-rated supplies to claim refund of input tax credit on in-

puts, input services and capital goods. However, Section 16 of IGST Act, 2017

provides that refund shall be claimed in accordance with Section 54 of CGST Act,

2017 or the rules made thereunder.

Now it is pertinent to examine Section 54 of CGST Act, 2017 which pro-

vides provisions related to claiming of refund. Section 54(1) provides -

“54. (1) Any person claiming refund of any tax and interest, if any, paid on

such tax or any other amount paid by him, may make an application before

the expiry of two years from the relevant date in such form and manner as may

be prescribed”.

The term refund has been defined in explanation to Section 54 which reads as fol-

lows :

“Refund includes refund of tax paid on zero-rated supplies of goods or ser-

vices or both or on inputs or input services used in making such zero-rated

supplies, or refund of tax on the supply of goods regarded as deemed ex-

ports, or refund of unutilised input tax credit as provided under sub-section (3).”

Sub-section (3) to Section 54 allows a registered person who is engaged in provi-

sion of zero-rated supplies to claim refund of unutilised input tax credit. As ex-

plained in previous paragraphs, the term input tax credit does not differentiate

between input tax credit on inputs, input services and capital goods. Therefore,

even this implies that Section 54 also entitles the refund of input tax credit on

capital goods.

Further, the term refund has been defined in an inclusive manner, which

implies that the scope of that term is not restricted to expressions included in it.

Hence, it is even clear that refund includes the refund of unutilised input tax

credit relating to inputs, input services and capital goods but not restricted to

inputs and input services.

However, the form and manner in which the refund application should

be filed has been prescribed in Rule 89 of CGST Rules, 2017. Rule 89(4) provides

the formula as per which refund shall be granted and this reads as follows :

(4) In the case of zero-rated supply of goods or services or both without payment of

tax under bond or letter of undertaking in accordance with the provisions of

sub-section (3) of section 16 of the Integrated Goods and Services Tax Act,

2017 (13 of 2017), refund of input tax credit shall be granted as per the following

formula -

GST LAW TIMES 28th May 2020 31