Page 51 - GSTL_ 28th May 2020_Vol 36_Part 4

P. 51

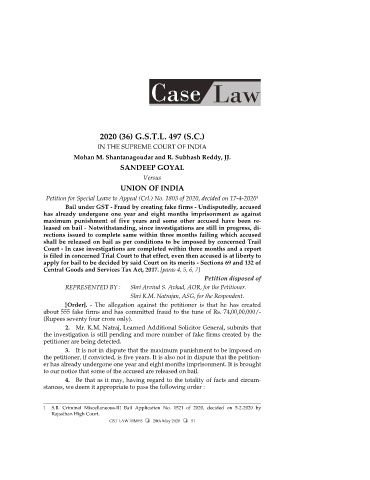

2020 (36) G.S.T.L. 497 (S.C.)

IN THE SUPREME COURT OF INDIA

Mohan M. Shantanagoudar and R. Subhash Reddy, JJ.

SANDEEP GOYAL

Versus

UNION OF INDIA

Petition for Special Leave to Appeal (Crl.) No. 1803 of 2020, decided on 17-4-2020

1

Bail under GST - Fraud by creating fake firms - Undisputedly, accused

has already undergone one year and eight months imprisonment as against

maximum punishment of five years and some other accused have been re-

leased on bail - Notwithstanding, since investigations are still in progress, di-

rections issued to complete same within three months failing which accused

shall be released on bail as per conditions to be imposed by concerned Trail

Court - In case investigations are completed within three months and a report

is filed in concerned Trial Court to that effect, even then accused is at liberty to

apply for bail to be decided by said Court on its merits - Sections 69 and 132 of

Central Goods and Services Tax Act, 2017. [paras 4, 5, 6, 7]

Petition disposed of

REPRESENTED BY : Shri Arvind S. Avhad, AOR, for the Petitioner.

Shri K.M. Natrajan, ASG, for the Respondent.

[Order]. - The allegation against the petitioner is that he has created

about 555 fake firms and has committed fraud to the tune of Rs. 74,00,00,000/-

(Rupees seventy four crore only).

2. Mr. K.M. Natraj, Learned Additional Solicitor General, submits that

the investigation is still pending and more number of fake firms created by the

petitioner are being detected.

3. It is not in dispute that the maximum punishment to be imposed on

the petitioner, if convicted, is five years. It is also not in dispute that the petition-

er has already undergone one year and eight months imprisonment. It is brought

to our notice that some of the accused are released on bail.

4. Be that as it may, having regard to the totality of facts and circum-

stances, we deem it appropriate to pass the following order :

________________________________________________________________________

1 S.B. Criminal Miscellaneous-III Bail Application No. 1521 of 2020, decided on 5-2-2020 by

Rajasthan High Court.

GST LAW TIMES 28th May 2020 51