Page 126 - GSTL_2nd July 2020 _Vol 38_Part 1

P. 126

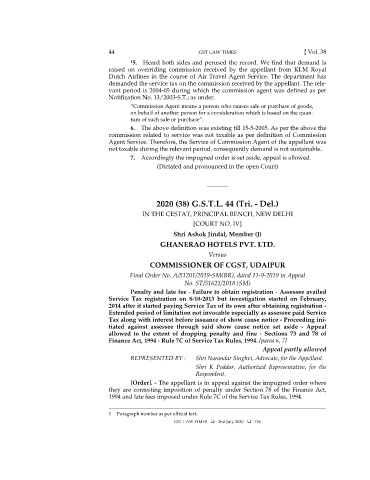

44 GST LAW TIMES [ Vol. 38

1 5. Heard both sides and perused the record. We find that demand is

raised on overriding commission received by the appellant from KLM Royal

Dutch Airlines in the course of Air Travel Agent Service. The department has

demanded the service tax on the commission received by the appellant. The rele-

vant period is 2004-05 during which the commission agent was defined as per

Notification No. 13/2003-S.T.; as under.

“Commission Agent means a person who causes sale or purchase of goods,

on behalf of another person for a consideration which is based on the quan-

tum of such sale or purchase”.

6. The above definition was existing till 15-5-2005. As per the above the

commission related to service was not taxable as per definition of Commission

Agent Service. Therefore, the Service of Commission Agent of the appellant was

not taxable during the relevant period, consequently demand is not sustainable.

7. Accordingly the impugned order is set aside, appeal is allowed.

(Dictated and pronounced in the open Court)

_______

2020 (38) G.S.T.L. 44 (Tri. - Del.)

IN THE CESTAT, PRINCIPAL BENCH, NEW DELHI

[COURT NO. IV]

Shri Ashok Jindal, Member (J)

GHANERAO HOTELS PVT. LTD.

Versus

COMMISSIONER OF CGST, UDAIPUR

Final Order No. A/51201/2019-SM(BR), dated 11-9-2019 in Appeal

No. ST/51621/2018 (SM)

Penalty and late fee - Failure to obtain registration - Assessee availed

Service Tax registration on 8-10-2013 but investigation started on February,

2014 after it started paying Service Tax of its own after obtaining registration -

Extended period of limitation not invocable especially as assessee paid Service

Tax along with interest before issuance of show cause notice - Proceeding ini-

tiated against assessee through said show cause notice set aside - Appeal

allowed to the extent of dropping penalty and fine - Sections 73 and 78 of

Finance Act, 1994 - Rule 7C of Service Tax Rules, 1994. [paras 6, 7]

Appeal partly allowed

REPRESENTED BY : Shri Narandar Singhvi, Advocate, for the Appellant.

Shri K Poddar, Authorized Representative, for the

Respondent.

[Order]. - The appellant is in appeal against the impugned order where

they are contesting imposition of penalty under Section 78 of the Finance Act,

1994 and late fees imposed under Rule 7C of the Service Tax Rules, 1994.

________________________________________________________________________

1 Paragraph number as per official text.

GST LAW TIMES 2nd July 2020 126