Page 224 - GSTL_2nd July 2020 _Vol 38_Part 1

P. 224

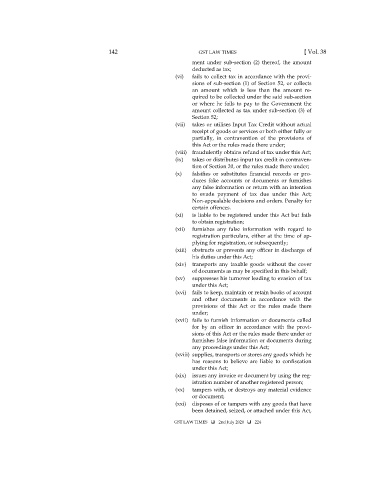

142 GST LAW TIMES [ Vol. 38

ment under sub-section (2) thereof, the amount

deducted as tax;

(vi) fails to collect tax in accordance with the provi-

sions of sub-section (1) of Section 52, or collects

an amount which is less than the amount re-

quired to be collected under the said sub-section

or where he fails to pay to the Government the

amount collected as tax under sub-section (3) of

Section 52;

(vii) takes or utilises Input Tax Credit without actual

receipt of goods or services or both either fully or

partially, in contravention of the provisions of

this Act or the rules made there under;

(viii) fraudulently obtains refund of tax under this Act;

(ix) takes or distributes input tax credit in contraven-

tion of Section 20, or the rules made there under;

(x) falsifies or substitutes financial records or pro-

duces fake accounts or documents or furnishes

any false information or return with an intention

to evade payment of tax due under this Act;

Non-appealable decisions and orders. Penalty for

certain offences.

(xi) is liable to be registered under this Act but fails

to obtain registration;

(xii) furnishes any false information with regard to

registration particulars, either at the time of ap-

plying for registration, or subsequently;

(xiii) obstructs or prevents any officer in discharge of

his duties under this Act;

(xiv) transports any taxable goods without the cover

of documents as may be specified in this behalf;

(xv) suppresses his turnover leading to evasion of tax

under this Act;

(xvi) fails to keep, maintain or retain books of account

and other documents in accordance with the

provisions of this Act or the rules made there

under;

(xvii) fails to furnish information or documents called

for by an officer in accordance with the provi-

sions of this Act or the rules made there under or

furnishes false information or documents during

any proceedings under this Act;

(xviii) supplies, transports or stores any goods which he

has reasons to believe are liable to confiscation

under this Act;

(xix) issues any invoice or document by using the reg-

istration number of another registered person;

(xx) tampers with, or destroys any material evidence

or document;

(xxi) disposes of or tampers with any goods that have

been detained, seized, or attached under this Act,

GST LAW TIMES 2nd July 2020 224