Page 52 - GSTL_2nd July 2020 _Vol 38_Part 1

P. 52

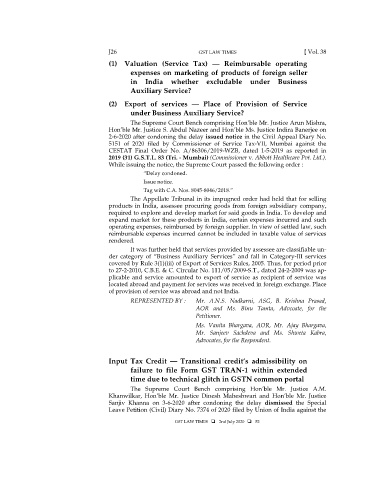

J26 GST LAW TIMES [ Vol. 38

(1) Valuation (Service Tax) — Reimbursable operating

expenses on marketing of products of foreign seller

in India whether excludable under Business

Auxiliary Service?

(2) Export of services — Place of Provision of Service

under Business Auxiliary Service?

The Supreme Court Bench comprising Hon’ble Mr. Justice Arun Mishra,

Hon’ble Mr. Justice S. Abdul Nazeer and Hon’ble Ms. Justice Indira Banerjee on

2-6-2020 after condoning the delay issued notice in the Civil Appeal Diary No.

5151 of 2020 filed by Commissioner of Service Tax-VII, Mumbai against the

CESTAT Final Order No. A/86306/2019-WZB, dated 1-5-2019 as reported in

2019 (31) G.S.T.L. 83 (Tri. - Mumbai) (Commissioner v. Abbott Healthcare Pvt. Ltd.).

While issuing the notice, the Supreme Court passed the following order :

“Delay condoned.

Issue notice.

Tag with C.A. Nos. 8045-8046/2018.”

The Appellate Tribunal in its impugned order had held that for selling

products in India, assessee procuring goods from foreign subsidiary company,

required to explore and develop market for said goods in India. To develop and

expand market for these products in India, certain expenses incurred and such

operating expenses, reimbursed by foreign supplier. In view of settled law, such

reimbursable expenses incurred cannot be included in taxable value of services

rendered.

It was further held that services provided by assessee are classifiable un-

der category of “Business Auxiliary Services” and fall in Category-III services

covered by Rule 3(1)(iii) of Export of Services Rules, 2005. Thus, for period prior

to 27-2-2010, C.B.E. & C. Circular No. 111/05/2009-S.T., dated 24-2-2009 was ap-

plicable and service amounted to export of service as recipient of service was

located abroad and payment for services was received in foreign exchange. Place

of provision of service was abroad and not India.

REPRESENTED BY : Mr. A.N.S. Nadkarni, ASG, B. Krishna Prasad,

AOR and Ms. Binu Tamta, Advcoate, for the

Petitioner.

Ms. Vanita Bhargava, AOR, Mr. Ajay Bhargava,

Mr. Sanjeev Sachdeva and Ms. Shweta Kabra,

Advocates, for the Respondent.

Input Tax Credit — Transitional credit’s admissibility on

failure to file Form GST TRAN-1 within extended

time due to technical glitch in GSTN common portal

The Supreme Court Bench comprising Hon’ble Mr. Justice A.M.

Khanwilkar, Hon’ble Mr. Justice Dinesh Maheshwari and Hon’ble Mr. Justice

Sanjiv Khanna on 3-6-2020 after condoning the delay dismissed the Special

Leave Petition (Civil) Diary No. 7374 of 2020 filed by Union of India against the

GST LAW TIMES 2nd July 2020 52

( A26 )