Page 81 - GSTL_2nd July 2020 _Vol 38_Part 1

P. 81

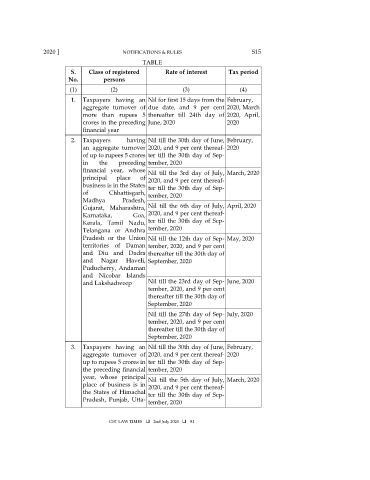

2020 ] NOTIFICATIONS & RULES S15

TABLE

S. Class of registered Rate of interest Tax period

No. persons

(1) (2) (3) (4)

1. Taxpayers having an Nil for first 15 days from the February,

aggregate turnover of due date, and 9 per cent 2020, March

more than rupees 5 thereafter till 24th day of 2020, April,

crores in the preceding June, 2020 2020

financial year

2. Taxpayers having Nil till the 30th day of June, February,

an aggregate turnover 2020, and 9 per cent thereaf- 2020

of up to rupees 5 crores ter till the 30th day of Sep-

in the preceding tember, 2020

financial year, whose Nil till the 3rd day of July, March, 2020

principal place of 2020, and 9 per cent thereaf-

business is in the States ter till the 30th day of Sep-

of Chhattisgarh, tember, 2020

Madhya Pradesh,

Gujarat, Maharashtra, Nil till the 6th day of July, April, 2020

Karnataka, Goa, 2020, and 9 per cent thereaf-

Kerala, Tamil Nadu, ter till the 30th day of Sep-

Telangana or Andhra tember, 2020

Pradesh or the Union Nil till the 12th day of Sep- May, 2020

territories of Daman tember, 2020, and 9 per cent

and Diu and Dadra thereafter till the 30th day of

and Nagar Haveli, September, 2020

Puducherry, Andaman

and Nicobar Islands

and Lakshadweep Nil till the 23rd day of Sep- June, 2020

tember, 2020, and 9 per cent

thereafter till the 30th day of

September, 2020

Nil till the 27th day of Sep- July, 2020

tember, 2020, and 9 per cent

thereafter till the 30th day of

September, 2020

3. Taxpayers having an Nil till the 30th day of June, February,

aggregate turnover of 2020, and 9 per cent thereaf- 2020

up to rupees 5 crores in ter till the 30th day of Sep-

the preceding financial tember, 2020

year, whose principal Nil till the 5th day of July, March, 2020

place of business is in 2020, and 9 per cent thereaf-

the States of Himachal ter till the 30th day of Sep-

Pradesh, Punjab, Utta- tember, 2020

GST LAW TIMES 2nd July 2020 81