Page 125 - ELT_3rd_1st May 2020_Vol 372_Part

P. 125

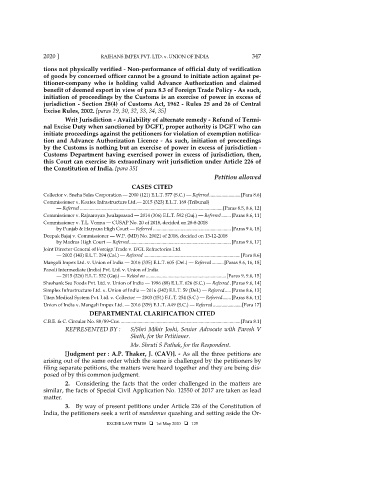

2020 ] RAJHANS IMPEX PVT. LTD. v. UNION OF INDIA 347

tions not physically verified - Non-performance of official duty of verification

of goods by concerned officer cannot be a ground to initiate action against pe-

titioner-company who is holding valid Advance Authorization and claimed

benefit of deemed export in view of para 8.3 of Foreign Trade Policy - As such,

initiation of proceedings by the Customs is an exercise of power in excess of

jurisdiction - Section 28(4) of Customs Act, 1962 - Rules 25 and 26 of Central

Excise Rules, 2002. [paras 29, 30, 32, 33, 34, 35]

Writ Jurisdiction - Availability of alternate remedy - Refund of Termi-

nal Excise Duty when sanctioned by DGFT, proper authority is DGFT who can

initiate proceedings against the petitioners for violation of exemption notifica-

tion and Advance Authorization Licence - As such, initiation of proceedings

by the Customs is nothing but an exercise of power in excess of jurisdiction -

Customs Department having exercised power in excess of jurisdiction, then,

this Court can exercise its extraordinary writ jurisdiction under Article 226 of

the Constitution of India. [para 35]

Petition allowed

CASES CITED

Collector v. Sneha Sales Corporation — 2000 (121) E.L.T. 577 (S.C.) — Referred .......................... [Para 8.6]

Commissioner v. Koatex Infrastructure Ltd.— 2015 (323) E.L.T. 169 (Tribunal)

— Referred ....................................................................................................................... [Paras 8.5, 8.6, 12]

Commissioner v. Rajnarayan Jwalaprasad — 2014 (306) E.L.T. 592 (Guj.) — Referred ........ [Paras 8.6, 11]

Commissioner v. T.L. Verma — CUSAP No. 20 of 2018, decided on 28-8-2018

by Punjab & Haryana High Court — Referred ................................................................. [Paras 9.6, 18]

Deepak Bajaj v. Commissioner — W.P. (MD) No. 20021 of 2018, decided on 13-12-2018

by Madras High Court — Referred ..................................................................................... [Paras 9.6, 17]

Joint Director General of Foreign Trade v. IFGL Refractories Ltd.

— 2002 (143) E.L.T. 294 (Cal.) — Referred ................................................................................. [Para 8.6]

Mangali Impex Ltd. v. Union of India — 2016 (335) E.L.T. 605 (Del.) — Referred .......... [Paras 9.6, 16, 18]

Panoli Intermediate (India) Pvt. Ltd. v. Union of India

— 2015 (326) E.L.T. 532 (Guj.) — Relied on ................................................................... [Paras 9, 9.6, 15]

Sheshank Sea Foods Pvt. Ltd. v. Union of India — 1996 (88) E.L.T. 626 (S.C.) — Referred . [Paras 9.6, 14]

Simplex Infrastructure Ltd. v. Union of India — 2016 (342) E.L.T. 59 (Del.) — Referred ..... [Paras 8.6, 13]

Titan Medical System Pvt. Ltd. v. Collector — 2003 (151) E.L.T. 254 (S.C.) — Referred ....... [Paras 8.6, 11]

Union of India v. Mangali Impex Ltd. — 2016 (339) E.L.T. A49 (S.C.) — Referred ........................ [Para 17]

DEPARTMENTAL CLARIFICATION CITED

C.B.E. & C. Circular No. 88/89-Cus. .................................................................................................... [Para 8.1]

REPRESENTED BY : S/Shri Mihir Joshi, Senior Advocate with Paresh V

Sheth, for the Petitioner.

Ms. Shruti S Pathak, for the Respondent.

[Judgment per : A.P. Thaker, J. (CAV)]. - As all the three petitions are

arising out of the same order which the same is challenged by the petitioners by

filing separate petitions, the matters were heard together and they are being dis-

posed of by this common judgment.

2. Considering the facts that the order challenged in the matters are

similar, the facts of Special Civil Application No. 12550 of 2017 are taken as lead

matter.

3. By way of present petitions under Article 226 of the Constitution of

India, the petitioners seek a writ of mandamus quashing and setting aside the Or-

EXCISE LAW TIMES 1st May 2020 125