Page 225 - ELT_3rd_1st May 2020_Vol 372_Part

P. 225

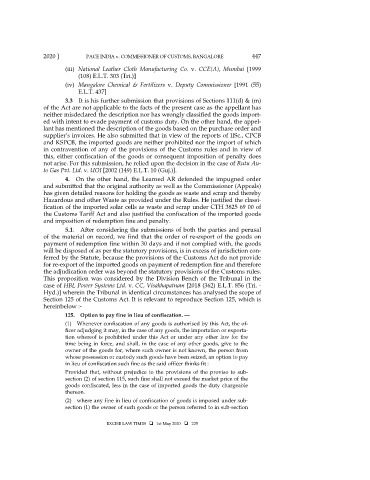

2020 ] PACE INDIA v. COMMISSIONER OF CUSTOMS, BANGALORE 447

(iii) National Leather Cloth Manufacturing Co. v. CCE(A), Mumbai [1999

(108) E.L.T. 303 (Tri.)]

(iv) Mangalore Chemical & Fertilizers v. Deputy Commissioner [1991 (55)

E.L.T. 437]

3.3 It is his further submission that provisions of Sections 111(d) & (m)

of the Act are not applicable to the facts of the present case as the appellant has

neither misdeclared the description nor has wrongly classified the goods import-

ed with intent to evade payment of customs duty. On the other hand, the appel-

lant has mentioned the description of the goods based on the purchase order and

supplier’s invoices. He also submitted that in view of the reports of IISc., CPCB

and KSPCB, the imported goods are neither prohibited nor the import of which

in contravention of any of the provisions of the Customs rules and in view of

this, either confiscation of the goods or consequent imposition of penalty does

not arise. For this submission, he relied upon the decision in the case of Rutu Au-

to Gas Pvt. Ltd. v. UOI [2002 (149) E.L.T. 10 (Guj.)].

4. On the other hand, the Learned AR defended the impugned order

and submitted that the original authority as well as the Commissioner (Appeals)

has given detailed reasons for holding the goods as waste and scrap and thereby

Hazardous and other Waste as provided under the Rules. He justified the classi-

fication of the imported solar cells as waste and scrap under CTH 3825 69 00 of

the Customs Tariff Act and also justified the confiscation of the imported goods

and imposition of redemption fine and penalty.

5.1. After considering the submissions of both the parties and perusal

of the material on record, we find that the order of re-export of the goods on

payment of redemption fine within 30 days and if not complied with, the goods

will be disposed of as per the statutory provisions, is in excess of jurisdiction con-

ferred by the Statute, because the provisions of the Customs Act do not provide

for re-export of the imported goods on payment of redemption fine and therefore

the adjudication order was beyond the statutory provisions of the Customs rules.

This proposition was considered by the Division Bench of the Tribunal in the

case of HBL Power Systems Ltd. v. CC, Visakhapatnam [2018 (362) E.L.T. 856 (Tri. -

Hyd.)] wherein the Tribunal in identical circumstances has analysed the scope of

Section 125 of the Customs Act. It is relevant to reproduce Section 125, which is

hereinbelow :-

125. Option to pay fine in lieu of confiscation. —

(1) Whenever confiscation of any goods is authorised by this Act, the of-

ficer adjudging it may, in the case of any goods, the importation or exporta-

tion whereof is prohibited under this Act or under any other law for the

time being in force, and shall, in the case of any other goods, give to the

owner of the goods for, where such owner is not known, the person from

whose possession or custody such goods have been seized, an option to pay

in lieu of confiscation such fine as the said officer thinks fit :

Provided that, without prejudice to the provisions of the proviso to sub-

section (2) of section 115, such fine shall not exceed the market price of the

goods confiscated, less in the case of imported goods the duty chargeable

thereon.

(2) where any fine in lieu of confiscation of goods is imposed under sub-

section (1) the owner of such goods or the person referred to in sub-section

EXCISE LAW TIMES 1st May 2020 225