Page 230 - ELT_3rd_1st May 2020_Vol 372_Part

P. 230

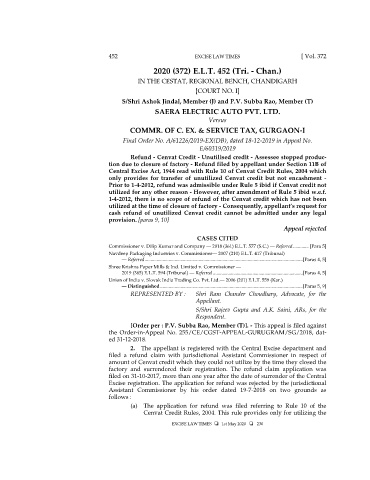

452 EXCISE LAW TIMES [ Vol. 372

2020 (372) E.L.T. 452 (Tri. - Chan.)

IN THE CESTAT, REGIONAL BENCH, CHANDIGARH

[COURT NO. I]

S/Shri Ashok Jindal, Member (J) and P.V. Subba Rao, Member (T)

SAERA ELECTRIC AUTO PVT. LTD.

Versus

COMMR. OF C. EX. & SERVICE TAX, GURGAON-I

Final Order No. A/61226/2019-EX(DB), dated 18-12-2019 in Appeal No.

E/60319/2019

Refund - Cenvat Credit - Unutilised credit - Assessee stopped produc-

tion due to closure of factory - Refund filed by appellant under Section 11B of

Central Excise Act, 1944 read with Rule 10 of Cenvat Credit Rules, 2004 which

only provides for transfer of unutilized Cenvat credit but not encashment -

Prior to 1-4-2012, refund was admissible under Rule 5 ibid if Cenvat credit not

utilized for any other reason - However, after amendment of Rule 5 ibid w.e.f.

1-4-2012, there is no scope of refund of the Cenvat credit which has not been

utilized at the time of closure of factory - Consequently, appellant’s request for

cash refund of unutilized Cenvat credit cannot be admitted under any legal

provision. [paras 9, 10]

Appeal rejected

CASES CITED

Commissioner v. Dilip Kumar and Company — 2018 (361) E.L.T. 577 (S.C.) — Referred ............. [Para 5]

Navdeep Packaging Industries v. Commissioner— 2007 (210) E.L.T. 417 (Tribunal)

— Referred .................................................................................................................................... [Paras 4, 5]

Shree Krishna Paper Mills & Ind. Limited v. Commissioner —

2019 (365) E.L.T. 594 (Tribunal) — Referred ........................................................................... [Paras 4, 5]

Union of India v. Slovak India Trading Co. Pvt. Ltd.— 2006 (201) E.L.T. 559 (Kar.)

— Distinguished ....................................................................................................................... [Paras 5, 9]

REPRESENTED BY : Shri Ram Chander Choudhary, Advocate, for the

Appellant.

S/Shri Rajeev Gupta and A.K. Saini, ARs, for the

Respondent.

[Order per : P.V. Subba Rao, Member (T)]. - This appeal is filed against

the Order-in-Appeal No. 255/CE/CGST-APPEAL-GURUGRAM/SG/2018, dat-

ed 31-12-2018.

2. The appellant is registered with the Central Excise department and

filed a refund claim with jurisdictional Assistant Commissioner in respect of

amount of Cenvat credit which they could not utilize by the time they closed the

factory and surrendered their registration. The refund claim application was

filed on 31-10-2017, more than one year after the date of surrender of the Central

Excise registration. The application for refund was rejected by the jurisdictional

Assistant Commissioner by his order dated 19-7-2018 on two grounds as

follows :

(a) The application for refund was filed referring to Rule 10 of the

Cenvat Credit Rules, 2004. This rule provides only for utilizing the

EXCISE LAW TIMES 1st May 2020 230