Page 233 - ELT_3rd_1st May 2020_Vol 372_Part

P. 233

2020 ]APOLLO TYRES LTD. v. COMMR. OF CUS. (EXPORT), JNCH, NHAVA SHEVA, RAIGAD 455

refund of the Cenvat credit if the Cenvat credit could not be utilized for any oth-

er reason. In that context, the Hon’ble High Court of Karnataka in the case of Slo-

vak India Trading Company Pvt. Ltd. (supra) has held that refund of the Cenvat

credit is admissible under Rule 5 of the Cenvat Credit Rules, 2004 if the factory is

closed. Subsequently, this rule has been amended and right now there is no

scope of refund of the Cenvat credit which has not been utilized at the time of

closer of the factory. At any rate, the appellant’s application was not under Rule

5 of the Cenvat Credit Rules, 2004.

10. In view of the above, we find that the appellant’s request for cash

refund of unutilized Cenvat credit cannot be admitted under any legal provision.

11. The appeal is rejected and the impugned order is upheld.

(Dictated and pronounced in the open Court)

_______

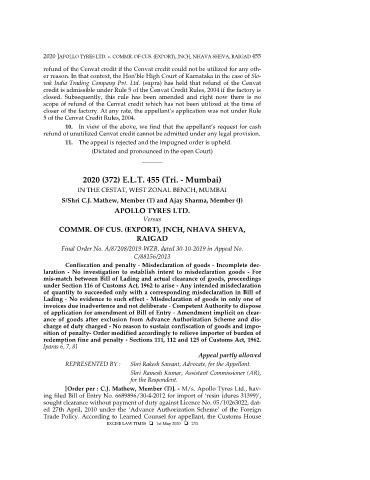

2020 (372) E.L.T. 455 (Tri. - Mumbai)

IN THE CESTAT, WEST ZONAL BENCH, MUMBAI

S/Shri C.J. Mathew, Member (T) and Ajay Sharma, Member (J)

APOLLO TYRES LTD.

Versus

COMMR. OF CUS. (EXPORT), JNCH, NHAVA SHEVA,

RAIGAD

Final Order No. A/87208/2019-WZB, dated 30-10-2019 in Appeal No.

C/88156/2013

Confiscation and penalty - Misdeclaration of goods - Incomplete dec-

laration - No investigation to establish intent to misdeclaration goods - For

mis-match between Bill of Lading and actual clearance of goods, proceedings

under Section 116 of Customs Act, 1962 to arise - Any intended misdeclaration

of quantity to succeeded only with a corresponding misdeclaration in Bill of

Lading - No evidence to such effect - Misdeclaration of goods in only one of

invoices due inadvertence and not deliberate - Competent Authority to dispose

of application for amendment of Bill of Entry - Amendment implicit on clear-

ance of goods after exclusion from Advance Authorization Scheme and dis-

charge of duty charged - No reason to sustain confiscation of goods and impo-

sition of penalty- Order modified accordingly to relieve importer of burden of

redemption fine and penalty - Sections 111, 112 and 125 of Customs Act, 1962.

[paras 6, 7, 8]

Appeal partly allowed

REPRESENTED BY : Shri Rakesh Sawant, Advocate, for the Appellant.

Shri Ramesh Kumar, Assistant Commissioner (AR),

for the Respondent.

[Order per : C.J. Mathew, Member (T)]. - M/s. Apollo Tyres Ltd., hav-

ing filed Bill of Entry No. 6689896/30-4-2012 for import of ‘resin (dures 31399)’,

sought clearance without payment of duty against Licence No. 05/10263022, dat-

ed 27th April, 2010 under the ‘Advance Authorization Scheme’ of the Foreign

Trade Policy. According to Learned Counsel for appellant, the Customs House

EXCISE LAW TIMES 1st May 2020 233