Page 115 - ELT_1st June 2020_VOL 372_Part 5th

P. 115

2020 ] WADPACK PRIVATE LIMITED v. DIRECTOR GENERAL OF FOREIGN TRADE 649

deemed to have been exported are in fact received by the SEZ Unit and are ac-

counted as Deemed Exports.

10. I have considered the submissions made by the Learned Counsels

for the parties.

11. To answer the submissions made by the respective Counsels for the

parties, certain provisions of Foreign Trade Policy, Handbook of Procedures and

the SEZ Rules, 2006 need to be considered.

12. Paragraph 4.13 of the Foreign Trade Policy, 2004-2009, deals with

“Advance Authorization Scheme” and provides that an Advance Authorization

is issued to allow Duty Free Import of input duly and physically incorporated in

export directed (making normal allowance for wastage). Such Advance Authori-

zation can be issued either to manufacturer exporters or merchant exporters tied

to support manufacturer(s) for inter alia physical exports (including exports to

SEZ). Paragraph 4.1.6 further states that exports to SEZ units, irrespective of cur-

rency of realization, would be covered.

13. The Handbook of Procedures, 2009-2014 as also 2015-2020, in Para-

graph 4.12 and Paragraph 4.27 respectively, requires the shipping/supply doc-

ument(s) to be endorsed with File Number or Authorisation Number to establish

co-relation of export/supplies with the Authorization issued. Paragraph 4.25 fur-

ther provides that the Authorization Holder shall furnish prescribed document

in ANF-4F in support of fulfilment of export obligation.

14. Paragraph 5 of the condition attached to the Advance Authorization

specifically draws the attention of the petitioner to paragraph 4.25 and states that

the documents prescribed therein must be delivered for claiming discharge of

export-obligation.

15. Form ANF-4F, which is the Application form for ‘Redemption/No

Bond Certificate against Advance Authorization’ further requires submission of

shipping bill against the details of physical exports/deemed exports made.

16. Paragraph 2.5 of the Foreign Trade Policy empowers the DGFT to

pass orders granting relaxation or relief from policy/procedure. It reads as

under :

“2.5 Exemption from Policy/Procedure

DGFT may pass such orders or grant such relaxation or relief, as he may

deem fit and proper, on grounds of genuine hardship and averse impact on

trade.

DGFT may, in public interest, exempt any person or class or category of

persons from any provision of FTP or any procedure and may, while grant-

ing such exemption, impose such conditions as he may deem fit. Such re-

quest may be considered only after consulting Committees as under :

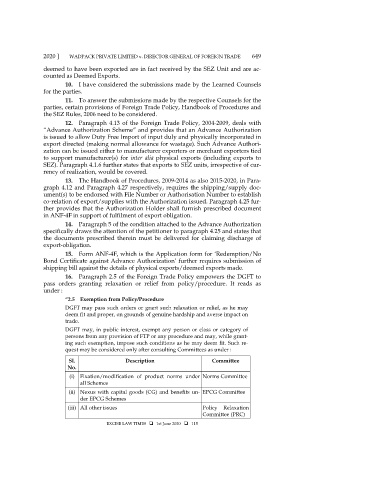

Sl. Description Committee

No.

(i) Fixation/modification of product norms under Norms Committee

all Schemes

(ii) Nexus with capital goods (CG) and benefits un- EPCG Committee

der EPCG Schemes

(iii) All other issues Policy Relaxation

Committee (PRC)

EXCISE LAW TIMES 1st June 2020 115