Page 193 - ELT_1st June 2020_VOL 372_Part 5th

P. 193

2020 ] GAURAV AGARWAL v. COMMISSIONER OF CUSTOMS, TIRUCHIRAPALLI 727

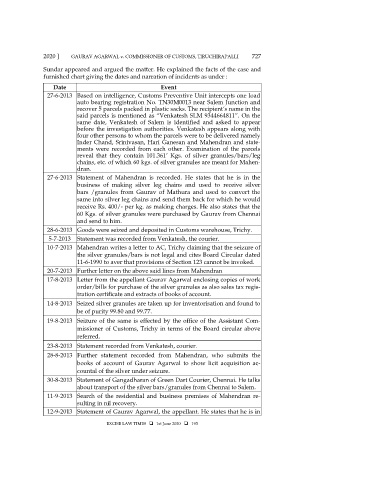

Sundar appeared and argued the matter. He explained the facts of the case and

furnished chart giving the dates and narration of incidents as under :

Date Event

27-6-2013 Based on intelligence, Customs Preventive Unit intercepts one load

auto bearing registration No. TN30M0013 near Salem Junction and

recover 5 parcels packed in plastic sacks. The recipient’s name in the

said parcels is mentioned as “Venkatesh SLM 9344664811”. On the

same date, Venkatesh of Salem is identified and asked to appear

before the investigation authorities. Venkatesh appears along with

four other persons to whom the parcels were to be delivered namely

Inder Chand, Srinivasan, Hari Ganesan and Mahendran and state-

ments were recorded from each other. Examination of the parcels

reveal that they contain 101.361’ Kgs. of silver granules/bars/leg

chains, etc. of which 60 kgs. of silver granules are meant for Mahen-

dran.

27-6-2013 Statement of Mahendran is recorded. He states that he is in the

business of making silver leg chains and used to receive silver

bars /granules from Gaurav of Mathura and used to convert the

same into silver leg chains and send them back for which he would

receive Rs. 400/- per kg. as making charges. He also states that the

60 Kgs. of silver granules were purchased by Gaurav from Chennai

and send to him.

28-6-2013 Goods were seized and deposited in Customs warehouse, Trichy.

5-7-2013 Statement was recorded from Venkatesh, the courier.

10-7-2013 Mahendran writes a letter to AC, Trichy claiming that the seizure of

the silver granules/bars is not legal and cites Board Circular dated

11-6-1990 to aver that provisions of Section 123 cannot be invoked.

20-7-2013 Further letter on the above said lines from Mahendran

17-8-2013 Letter from the appellant Gaurav Agarwal enclosing copies of work

order/bills for purchase of the silver granules as also sales tax regis-

tration certificate and extracts of books of account.

14-8-2013 Seized silver granules are taken up for inventorisation and found to

be of purity 99.80 and 99.77.

19-8-2013 Seizure of the same is effected by the office of the Assistant Com-

missioner of Customs, Trichy in terms of the Board circular above

referred.

23-8-2013 Statement recorded from Venkatesh, courier.

28-8-2013 Further statement recorded from Mahendran, who submits the

books of account of Gaurav Agarwal to show licit acquisition ac-

countal of the silver under seizure.

30-8-2013 Statement of Gangadharan of Green Dart Courier, Chennai. He talks

about transport of the silver bars/granules from Chennai to Salem.

11-9-2013 Search of the residential and business premises of Mahendran re-

sulting in nil recovery.

12-9-2013 Statement of Gaurav Agarwal, the appellant. He states that he is in

EXCISE LAW TIMES 1st June 2020 193