Page 194 - ELT_1st June 2020_VOL 372_Part 5th

P. 194

728 EXCISE LAW TIMES [ Vol. 372

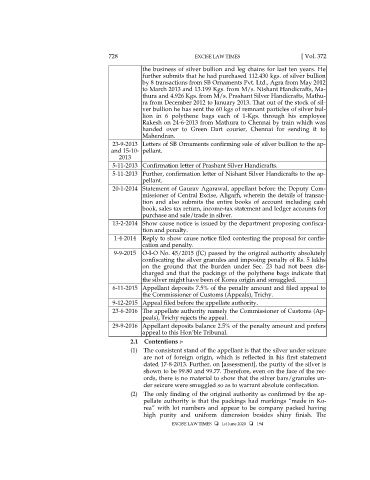

the business of silver bullion and leg chains for last ten years. He

further submits that he had purchased 112.430 kgs. of silver bullion

by 8 transactions from SB Ornaments Pvt. Ltd., Agra from May 2012

to March 2013 and 13.199 Kgs. from M/s. Nishant Handicrafts, Ma-

thura and 4.926 Kgs. from M/s. Prashant Silver Handicrafts, Mathu-

ra from December 2012 to January 2013. That out of the stock of sil-

ver bullion he has sent the 60 kgs of remnant particles of silver bul-

lion in 6 polythene bags each of 1-Kgs. through his employee

Rakesh on 24-6-2013 from Mathura to Chennai by train which was

handed over to Green Dart courier, Chennai for sending it to

Mahendran.

23-9-2013 Letters of SB Ornaments confirming sale of silver bullion to the ap-

and 15-10- pellant.

2013

5-11-2013 Confirmation letter of Prashant Silver Handicrafts.

5-11-2013 Further, confirmation letter of Nishant Silver Handicrafts to the ap-

pellant.

20-1-2014 Statement of Gaurav Agarawal, appellant before the Deputy Com-

missioner of Central Excise, Aligarh, wherein the details of transac-

tion and also submits the entire books of account including cash

book, sales tax return, income-tax statement and ledger accounts for

purchase and sale/trade in silver.

13-2-2014 Show cause notice is issued by the department proposing confisca-

tion and penalty.

1-4-2014 Reply to show cause notice filed contesting the proposal for confis-

cation and penalty.

9-9-2015 O-I-O No. 45/2015 (JC) passed by the original authority absolutely

confiscating the silver granules and imposing penalty of Rs. 5 lakhs

on the ground that the burden under Sec. 23 had not been dis-

charged and that the packings of the polythene bags indicate that

the silver might have been of Korea origin and smuggled.

6-11-2015 Appellant deposits 7.5% of the penalty amount and filed appeal to

the Commissioner of Customs (Appeals), Trichy.

9-12-2015 Appeal filed before the appellate authority.

23-6-2016 The appellate authority namely the Commissioner of Customs (Ap-

peals), Trichy rejects the appeal.

29-9-2016 Appellant deposits balance 2.5% of the penalty amount and prefers

appeal to this Hon’ble Tribunal.

2.1 Contentions :-

(1) The consistent stand of the appellant is that the silver under seizure

are not of foreign origin, which is reflected in his first statement

dated 17-8-2013. Further, on [assessment], the purity of the silver is

shown to be 99.80 and 99.77. Therefore, even on the face of the rec-

ords, there is no material to show that the silver bars/granules un-

der seizure were smuggled so as to warrant absolute confiscation.

(2) The only finding of the original authority as confirmed by the ap-

pellate authority is that the packings had markings “made in Ko-

rea” with lot numbers and appear to be company packed having

high purity and uniform dimension besides shiny finish. The

EXCISE LAW TIMES 1st June 2020 194