Page 199 - ELT_1st June 2020_VOL 372_Part 5th

P. 199

2020 ] GAURAV AGARWAL v. COMMISSIONER OF CUSTOMS, TIRUCHIRAPALLI 733

per the dictionary is “Platinum, Gold or Silver, which is in bulk quantities”. The

meaning of bullion thus does not take away platinum, gold or silver in the form

of grains/granules. Thus, granules also fall within the definition of bullion. This

would lead to the consequence that if the silver granules has foreign markings

even though less than 100 kgs. would not be covered by the above Board circular.

The next question then is whether silver granules in the present case has foreign

markings. Needless to say that marking cannot be endorsed on silver granules as

in case of silver coins or silver bars. The only practical way to endorse a marking

on silver in the form of granules is to mention the markings on the

packing/boxes which holds the silver granules. In the present case, the silver

granules were found in carton boxes on which there was specific mention of the

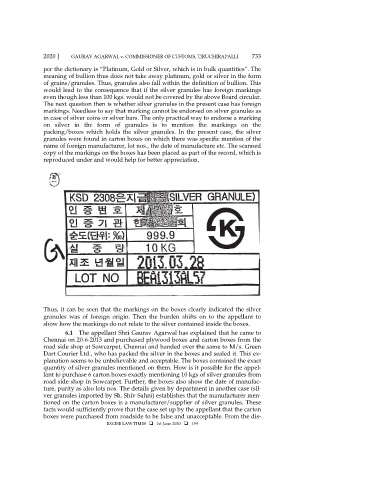

name of foreign manufacturer, lot nos., the date of manufacture etc. The scanned

copy of the markings on the boxes has been placed as part of the record, which is

reproduced under and would help for better appreciation.

Thus, it can be seen that the markings on the boxes clearly indicated the silver

granules was of foreign origin. Then the burden shifts on to the appellant to

show how the markings do not relate to the silver contained inside the boxes.

6.1 The appellant Shri Gaurav Agarwal has explained that he came to

Chennai on 20-6-2013 and purchased plywood boxes and carton boxes from the

road side shop at Sowcarpet, Chennai and handed over the same to M/s. Green

Dart Courier Ltd., who has packed the silver in the boxes and sealed it. This ex-

planation seems to be unbelievable and acceptable. The boxes contained the exact

quantity of silver granules mentioned on them. How is it possible for the appel-

lant to purchase 6 carton boxes exactly mentioning 10 kgs of silver granules from

road side shop in Sowcarpet. Further, the boxes also show the date of manufac-

ture, purity as also lots nos. The details given by department in another case (sil-

ver granules imported by Sh. Shiv Sahni) establishes that the manufacturer men-

tioned on the carton boxes is a manufacturer/supplier of silver granules. These

facts would sufficiently prove that the case set up by the appellant that the carton

boxes were purchased from roadside to be false and unacceptable. From the dis-

EXCISE LAW TIMES 1st June 2020 199