Page 203 - ELT_1st June 2020_VOL 372_Part 5th

P. 203

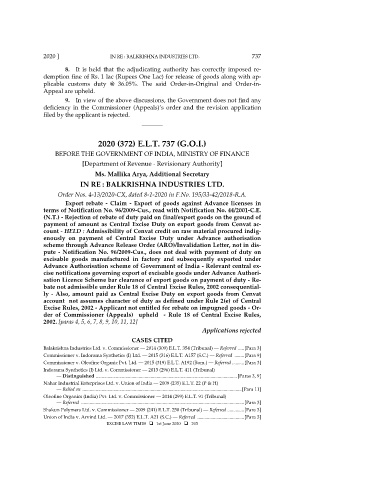

2020 ] IN RE : BALKRISHNA INDUSTRIES LTD. 737

8. It is held that the adjudicating authority has correctly imposed re-

demption fine of Rs. 1 lac (Rupees One Lac) for release of goods along with ap-

plicable customs duty @ 36.05%. The said Order-in-Original and Order-in-

Appeal are upheld.

9. In view of the above discussions, the Government does not find any

deficiency in the Commissioner (Appeals)’s order and the revision application

filed by the applicant is rejected.

_______

2020 (372) E.L.T. 737 (G.O.I.)

BEFORE THE GOVERNMENT OF INDIA, MINISTRY OF FINANCE

[Department of Revenue - Revisionary Authority]

Ms. Mallika Arya, Additional Secretary

IN RE : BALKRISHNA INDUSTRIES LTD.

Order Nos. 4-13/2020-CX, dated 8-1-2020 in F.No. 195/33-42/2018-R.A.

Export rebate - Claim - Export of goods against Advance licenses in

terms of Notification No. 96/2009-Cus., read with Notification No. 44/2001-C.E.

(N.T.) - Rejection of rebate of duty paid on final/export goods on the ground of

payment of amount as Central Excise Duty on export goods from Cenvat ac-

count - HELD : Admissibility of Cenvat credit on raw material procured indig-

enously on payment of Central Excise Duty under Advance authorisation

scheme through Advance Release Order (ARO)/Invalidation Letter, not in dis-

pute - Notification No. 96/2009-Cus., does not deal with payment of duty on

excisable goods manufactured in factory and subsequently exported under

Advance Authorisation scheme of Government of India - Relevant central ex-

cise notifications governing export of excisable goods under Advance Authori-

sation Licence Scheme bar clearance of export goods on payment of duty - Re-

bate not admissible under Rule 18 of Central Excise Rules, 2002 consequential-

ly - Also, amount paid as Central Excise Duty on export goods from Cenvat

account not assumes character of duty as defined under Rule 2(e) of Central

Excise Rules, 2002 - Applicant not entitled for rebate on impugned goods - Or-

der of Commissioner (Appeals) upheld - Rule 18 of Central Excise Rules,

2002. [paras 4, 5, 6, 7, 8, 9, 10, 11, 12]

Applications rejected

CASES CITED

Balakrishna Industries Ltd. v. Commissioner — 2014 (309) E.L.T. 354 (Tribunal) — Referred ..... [Para 3]

Commissioner v. Indorama Synthetics (I) Ltd. — 2015 (316) E.L.T. A157 (S.C.) — Referred ........ [Para 9]

Commissioner v. Oleofine Organic Pvt. Ltd. — 2015 (319) E.L.T. A192 (Bom.) — Referred .......... [Para 3]

Indorama Synthetics (I) Ltd. v. Commissioner — 2013 (296) E.L.T. 411 (Tribunal)

— Distinguished ...................................................................................................................... [Paras 3, 9]

Nahar Industrial Enterprises Ltd. v. Union of India — 2009 (235) E.L.T. 22 (P & H)

— Relied on ..................................................................................................................................... [Para 11]

Oleofine Organics (India) Pvt. Ltd. v. Commissioner — 2014 (299) E.L.T. 91 (Tribunal)

— Referred ........................................................................................................................................ [Para 3]

Shakun Polymers Ltd. v. Commissioner — 2009 (241) E.L.T. 250 (Tribunal) — Referred .............. [Para 3]

Union of India v. Arvind Ltd. — 2017 (352) E.L.T. A21 (S.C.) — Referred ....................................... [Para 3]

EXCISE LAW TIMES 1st June 2020 203