Page 41 - ELT_1st June 2020_VOL 372_Part 5th

P. 41

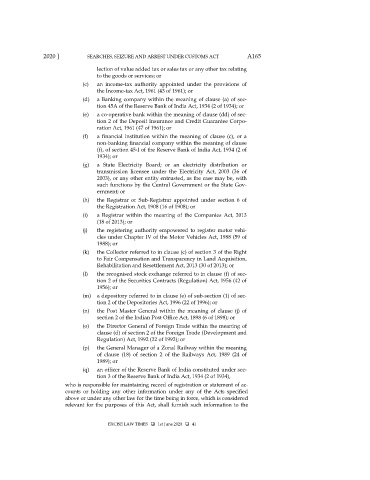

2020 ] SEARCHES, SEIZURE AND ARREST UNDER CUSTOMS ACT A165

lection of value added tax or sales tax or any other tax relating

to the goods or services; or

(c) an income-tax authority appointed under the provisions of

the Income-tax Act, 1961 (43 of 1961); or

(d) a Banking company within the meaning of clause (a) of sec-

tion 45A of the Reserve Bank of India Act, 1934 (2 of 1934); or

(e) a co-operative bank within the meaning of clause (dd) of sec-

tion 2 of the Deposit Insurance and Credit Guarantee Corpo-

ration Act, 1961 (47 of 1961); or

(f) a financial institution within the meaning of clause (c), or a

non-banking financial company within the meaning of clause

(f), of section 45-I of the Reserve Bank of India Act, 1934 (2 of

1934); or

(g) a State Electricity Board; or an electricity distribution or

transmission licensee under the Electricity Act, 2003 (36 of

2003), or any other entity entrusted, as the case may be, with

such functions by the Central Government or the State Gov-

ernment; or

(h) the Registrar or Sub-Registrar appointed under section 6 of

the Registration Act, 1908 (16 of 1908); or

(i) a Registrar within the meaning of the Companies Act, 2013

(18 of 2013); or

(j) the registering authority empowered to register motor vehi-

cles under Chapter IV of the Motor Vehicles Act, 1988 (59 of

1988); or

(k) the Collector referred to in clause (c) of section 3 of the Right

to Fair Compensation and Transparency in Land Acquisition,

Rehabilitation and Resettlement Act, 2013 (30 of 2013); or

(l) the recognised stock exchange referred to in clause (f) of sec-

tion 2 of the Securities Contracts (Regulation) Act, 1956 (42 of

1956); or

(m) a depository referred to in clause (e) of sub-section (1) of sec-

tion 2 of the Depositories Act, 1996 (22 of 1996); or

(n) the Post Master General within the meaning of clause (j) of

section 2 of the Indian Post Office Act, 1898 (6 of 1898); or

(o) the Director General of Foreign Trade within the meaning of

clause (d) of section 2 of the Foreign Trade (Development and

Regulation) Act, 1992 (22 of 1992); or

(p) the General Manager of a Zonal Railway within the meaning

of clause (18) of section 2 of the Railways Act, 1989 (24 of

1989); or

(q) an officer of the Reserve Bank of India constituted under sec-

tion 3 of the Reserve Bank of India Act, 1934 (2 of 1934),

who is responsible for maintaining record of registration or statement of ac-

counts or holding any other information under any of the Acts specified

above or under any other law for the time being in force, which is considered

relevant for the purposes of this Act, shall furnish such information to the

EXCISE LAW TIMES 1st June 2020 41