Page 196 - ELT_1st July 2020_Vol 373_Part 1

P. 196

106 EXCISE LAW TIMES [ Vol. 373

out to Rs. 1,48,301/-. Similarly, the total clearances during 1992-93 works out to

Rs. 32,28,220/- and the duty thereon is Rs. 5,56,868/-. Further it was found that

during June, 1993 to November, 1993, VIPI cleared goods worth Rs. 4,62,730/- in

excess of value declared in RT-12 returns, the duty on which worked out to Rs.

23,136/-. It was also found that VIPI has been maintaining a second set of invoic-

es and the duty involved on the duplicate invoices worked out to Rs. 4,24,264/

for the period 17-12-92 to 30-4-93. It was also found that VIPI had undervalued

their goods and differential duty on this account works out to Rs. 2,13,736/-.

There were some invoices without corresponding Central Excise gate passes, the

duty on which worked out to Rs. 22,486/-. Thus, the total demand of Rs.

13,88,790/- was made under Rule 9(2) of Central Excise Rules read with Section

11A of Central Excise Act on VIPI as above. It was also proposed to impose pen-

alty on them under Rule 9(2), 52A, 173Q and 226 of Central Excise Rules, 1944. It

was also proposed to confiscate machinery used for manufacture of goods under

Rule 173Q. Further, there was also a demand on VIPPL in this show cause notice.

It is alleged that from the auditor’s statement of VIPPL the total value on clear-

ances for Income Tax purposes was declared as Rs. 1,26,48,744/- during 1992-93.

After allowing necessary deductions, the assessable value works out to Rs.

1,14,82,180/- whereas the value declared with the Central Excise is only Rs.

1,05,24,501/-. Accordingly, differential duty on the value of Rs. 9,60,679/-

amounting to Rs. 1,65,717/- was demanded from them. It was further alleged

that VIPPL had maintained four separate registers and the total duty shown to

have been paid as per the registers in a month in excess of the amount of duty

actually paid as per RT-12 returns. Thus, it was concluded that VIPPL had col-

lected excess duty from their customers but did not deposited the same to the

Government Treasury and this amount works out to Rs. 1,52,241/-. Thus, it was

proposed to demand total duty of Rs. 3,17,958/- under Rule 9(2) read with Sec-

tion 11A. It was also proposed to impose penalties under Rules 9(2), 52A, 173Q

and 226 of the Rules. It was also proposed to confiscate plant and machinery and

impose personal penalty. In the impugned order the adjudicating authority has

demanded duty of Rs. 13,62,382/- from VIPI; he demanded duty of Rs. 3,17,958/-

from VIPL; he demanded interest on the above amounts from the two entities; he

confiscated plant and machinery of VIPI and gave them an option to redeem the

same on payment of Rs. 2 lakhs as fine. He further confiscated plant and machin-

ery of VIPPL and gave them an option to redeem the same on payment of fine of

Rs. 1 lakh; he imposed penalty of Rs. 2 lakhs on VIPI and Rs. 1 lakh on VIPPL

under Rules 9(2), 52A and 226. Further, he imposed personal penalty of Rs. 1

lakh on Smt. Meera Ramdas, Rs. 1 lakh on Shri C. Ramdas and Rs. 10,000/- on

Shri G. Muthyalu, their employee.

15. As far as the demand on VIPPL is concerned, Learned Counsel

submits as follows :

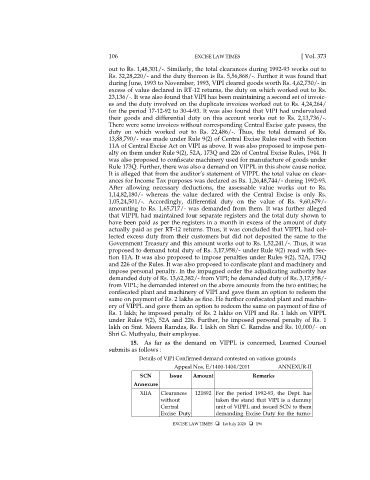

Details of VIPI Confirmed demand contested on various grounds

Appeal Nos. E/1400-1404/2011 ANNEXUR-II

SCN Issue Amount Remarks

Annexure

XIIA Clearances 121892 For the period 1992-93, the Dept. has

without taken the stand that VIPI is a dummy

Central unit of VIPPL and issued SCN to them

Excise Duty demanding Excise Duty for the turno-

EXCISE LAW TIMES 1st July 2020 196