Page 200 - ELT_1st July 2020_Vol 373_Part 1

P. 200

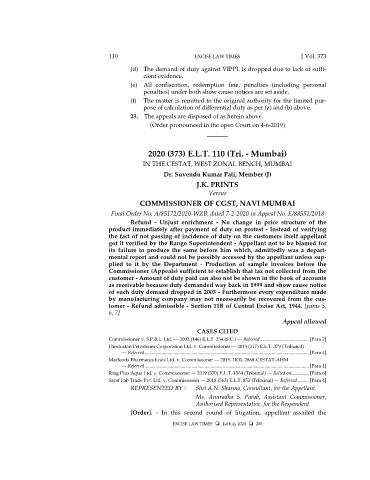

110 EXCISE LAW TIMES [ Vol. 373

(d) The demand of duty against VIPPL is dropped due to lack of suffi-

cient evidence.

(e) All confiscation, redemption fine, penalties (including personal

penalties) under both show cause notices are set aside.

(f) The matter is remitted to the original authority for the limited pur-

pose of calculation of differential duty as per (a) and (b) above.

23. The appeals are disposed of as herein above.

(Order pronounced in the open Court on 4-6-2019)

_______

2020 (373) E.L.T. 110 (Tri. - Mumbai)

IN THE CESTAT, WEST ZONAL BENCH, MUMBAI

Dr. Suvendu Kumar Pati, Member (J)

J.K. PRINTS

Versus

COMMISSIONER OF CGST, NAVI MUMBAI

Final Order No. A/85172/2020-WZB, dated 7-2-2020 in Appeal No. E/88551/2018

Refund - Unjust enrichment - No change in price structure of the

product immediately after payment of duty on protest - Instead of verifying

the fact of not passing of incidence of duty on the customers itself appellant

got it verified by the Range Superintendent - Appellant not to be blamed for

its failure to produce the same before him which, admittedly was a depart-

mental report and could not be possibly accessed by the appellant unless sup-

plied to it by the Department - Production of sample invoices before the

Commissioner (Appeals) sufficient to establish that tax not collected from the

customer - Amount of duty paid can also not be shown in the book of accounts

as receivable because duty demanded way back in 1999 and show cause notice

of such duty demand dropped in 2003 - Furthermore every expenditure made

by manufacturing company may not necessarily be recovered from the cus-

tomer - Refund admissible - Section 11B of Central Excise Act, 1944. [paras 5,

6, 7]

Appeal allowed

CASES CITED

Commissioner v. S.P.B.L. Ltd. — 2002 (146) E.L.T. 254 (S.C.) — Referred ........................................ [Para 2]

Hindustan Petroleum Corporation Ltd. v. Commissioner — 2019 (317) E.L.T. 379 (Tribunal)

— Referred ......................................................................................................................................... [Para 4]

Macleods Pharmaceuticals Ltd. v. Commissioner — 2019-TIOL-2868-CESTAT-AHM

— Referred ......................................................................................................................................... [Para 4]

Ring Plus Aqua Ltd. v. Commissioner — 2019 (370) E.L.T. 1364 (Tribunal) — Relied on .............. [Para 6]

Saraf Fab Trade Pvt. Ltd. v. Commissioner — 2018 (363) E.L.T. 853 (Tribunal) — Referred ......... [Para 4]

REPRESENTED BY : Shri A.N. Sharma, Consultant, for the Appellant.

Ms. Anuradha S. Parab, Assistant Commissioner,

Authorised Representative, for the Respondent.

[Order]. - In this second round of litigation, appellant assailed the

EXCISE LAW TIMES 1st July 2020 200