Page 203 - ELT_1st July 2020_Vol 373_Part 1

P. 203

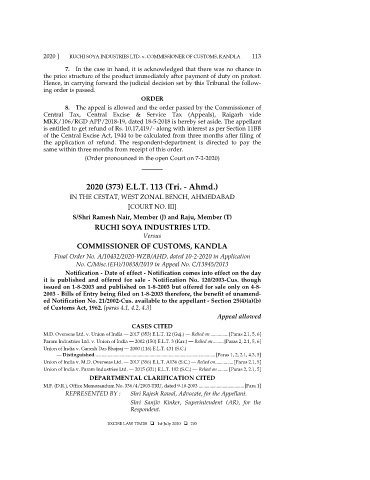

2020 ] RUCHI SOYA INDUSTRIES LTD. v. COMMISSIONER OF CUSTOMS, KANDLA 113

7. In the case in hand, it is acknowledged that there was no chance in

the price structure of the product immediately after payment of duty on protest.

Hence, in carrying forward the judicial decision set by this Tribunal the follow-

ing order is passed.

ORDER

8. The appeal is allowed and the order passed by the Commissioner of

Central Tax, Central Excise & Service Tax (Appeals), Raigarh vide

MKK/106/RGD APP/2018-19, dated 18-5-2018 is hereby set aside. The appellant

is entitled to get refund of Rs. 10,17,419/- along with interest as per Section 11BB

of the Central Excise Act, 1944 to be calculated from three months after filing of

the application of refund. The respondent-department is directed to pay the

same within three months from receipt of this order.

(Order pronounced in the open Court on 7-2-2020)

_______

2020 (373) E.L.T. 113 (Tri. - Ahmd.)

IN THE CESTAT, WEST ZONAL BENCH, AHMEDABAD

[COURT NO. III]

S/Shri Ramesh Nair, Member (J) and Raju, Member (T)

RUCHI SOYA INDUSTRIES LTD.

Versus

COMMISSIONER OF CUSTOMS, KANDLA

Final Order No. A/10432/2020-WZB/AHD, dated 10-2-2020 in Application

No. C/Misc.(EH)/10838/2019 in Appeal No. C/13945/2013

Notification - Date of effect - Notification comes into effect on the day

it is published and offered for sale - Notification No. 120/2003-Cus. though

issued on 1-8-2003 and published on 1-8-2003 but offered for sale only on 4-8-

2003 - Bills of Entry being filed on 1-8-2003 therefore, the benefit of unamend-

ed Notification No. 21/2002-Cus. available to the appellant - Section 25(4)(a)(b)

of Customs Act, 1962. [paras 4.1, 4.2, 4.3]

Appeal allowed

CASES CITED

M.D. Overseas Ltd. v. Union of India — 2017 (353) E.L.T. 12 (Guj.) — Relied on ............... [Paras 2.1, 5, 6]

Param Industries Ltd. v. Union of India — 2002 (150) E.L.T. 3 (Kar.) — Relied on ......... [Paras 2, 2.1, 5, 6]

Union of India v. Ganesh Das Bhojraj — 2000 (116) E.L.T. 431 (S.C.)

— Distinguished ..................................................................................................... [Paras 1, 2, 2.1, 4.3, 5]

Union of India v. M.D. Overseas Ltd. — 2017 (356) E.L.T. A136 (S.C.) — Relied on............... [Paras 2.1, 5]

Union of India v. Param Industries Ltd. — 2015 (321) E.L.T. 192 (S.C.) — Relied on ......... [Paras 2, 2.1, 5]

DEPARTMENTAL CLARIFICATION CITED

M.F. (D.R.), Office Memorandum No. 336/4/2003-TRU, dated 9-10-2003 ...................................... [Para 1]

REPRESENTED BY : Shri Rajesh Rawal, Advocate, for the Appellant.

Shri Sanjiv Kinker, Superintendent (AR), for the

Respondent.

EXCISE LAW TIMES 1st July 2020 203