Page 68 - ELT_1st July 2020_Vol 373_Part 1

P. 68

N4 EXCISE LAW TIMES [ Vol. 373

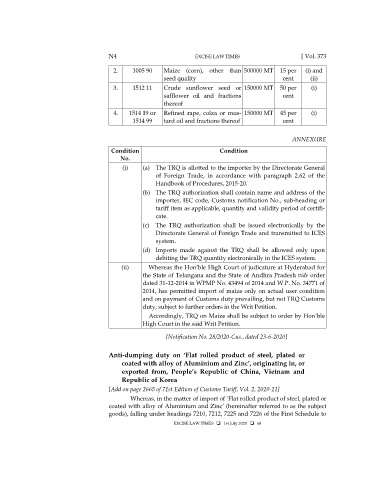

2. 1005 90 Maize (corn), other than 500000 MT 15 per (i) and

seed quality cent (ii)

3. 1512 11 Crude sunflower seed or 150000 MT 50 per (i)

safflower oil and fractions cent

thereof

4. 1514 19 or Refined rape, colza or mus- 150000 MT 45 per (i)

1514 99 tard oil and fractions thereof cent

ANNEXURE

Condition Condition

No.

(i) (a) The TRQ is allotted to the importer by the Directorate General

of Foreign Trade, in accordance with paragraph 2.62 of the

Handbook of Procedures, 2015-20.

(b) The TRQ authorization shall contain name and address of the

importer, IEC code, Customs notification No., sub-heading or

tariff item as applicable, quantity and validity period of certifi-

cate.

(c) The TRQ authorization shall be issued electronically by the

Directorate General of Foreign Trade and transmitted to ICES

system.

(d) Imports made against the TRQ shall be allowed only upon

debiting the TRQ quantity electronically in the ICES system.

(ii) Whereas the Hon’ble High Court of judicature at Hyderabad for

the State of Telangana and the State of Andhra Pradesh vide order

dated 31-12-2014 in WPMP No. 43494 of 2014 and W.P. No. 34771 of

2014, has permitted import of maize only on actual user condition

and on payment of Customs duty prevailing, but not TRQ Customs

duty, subject to further orders in the Writ Petition.

Accordingly, TRQ on Maize shall be subject to order by Hon’ble

High Court in the said Writ Petition.

[Notification No. 28/2020-Cus., dated 23-6-2020]

Anti-dumping duty on ‘Flat rolled product of steel, plated or

coated with alloy of Aluminium and Zinc’, originating in, or

exported from, People’s Republic of China, Vietnam and

Republic of Korea

[Add on page 2665 of 71st Edition of Customs Tariff, Vol. 2, 2020-21]

Whereas, in the matter of import of ‘Flat rolled product of steel, plated or

coated with alloy of Aluminium and Zinc’ (hereinafter referred to as the subject

goods), falling under headings 7210, 7212, 7225 and 7226 of the First Schedule to

EXCISE LAW TIMES 1st July 2020 68