Page 285 - ELT_15th July 2020_Vol 373_Part 2

P. 285

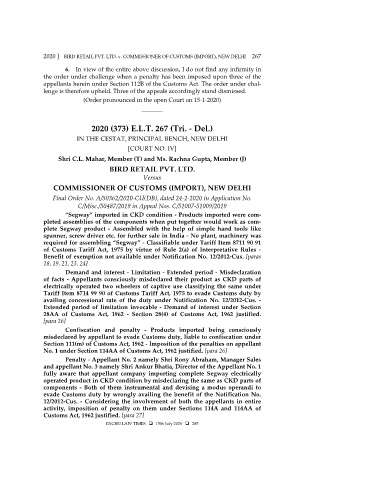

2020 ] BIRD RETAIL PVT. LTD. v. COMMISSIONER OF CUSTOMS (IMPORT), NEW DELHI 267

6. In view of the entire above discussion, I do not find any infirmity in

the order under challenge when a penalty has been imposed upon three of the

appellants herein under Section 112B of the Customs Act. The order under chal-

lenge is therefore upheld. Three of the appeals accordingly stand dismissed.

(Order pronounced in the open Court on 15-1-2020)

_______

2020 (373) E.L.T. 267 (Tri. - Del.)

IN THE CESTAT, PRINCIPAL BENCH, NEW DELHI

[COURT NO. IV]

Shri C.L. Mahar, Member (T) and Ms. Rachna Gupta, Member (J)

BIRD RETAIL PVT. LTD.

Versus

COMMISSIONER OF CUSTOMS (IMPORT), NEW DELHI

Final Order No. A/50362/2020-CU(DB), dated 24-2-2020 in Application No.

C/Misc./50487/2019 in Appeal Nos. C/51007-51009/2019

“Segway” imported in CKD condition - Products imported were com-

pleted assemblies of the components when put together would work as com-

plete Segway product - Assembled with the help of simple hand tools like

spanner, screw driver etc. for further sale in India - No plant, machinery was

required for assembling “Segway” - Classifiable under Tariff Item 8711 90 91

of Customs Tariff Act, 1975 by virtue of Rule 2(a) of Interpretative Rules -

Benefit of exemption not available under Notification No. 12/2012-Cus. [paras

18, 19, 21, 23, 24]

Demand and interest - Limitation - Extended period - Misdeclaration

of facts - Appellants consciously misdeclared their product as CKD parts of

electrically operated two wheelers of captive use classifying the same under

Tariff Item 8714 99 90 of Customs Tariff Act, 1975 to evade Customs duty by

availing concessional rate of the duty under Notification No. 12/2012-Cus. -

Extended period of limitation invocable - Demand of interest under Section

28AA of Customs Act, 1962 - Section 28(4) of Customs Act, 1962 justified.

[para 26]

Confiscation and penalty - Products imported being consciously

misdeclared by appellant to evade Customs duty, liable to confiscation under

Section 111(m) of Customs Act, 1962 - Imposition of the penalties on appellant

No. 1 under Section 114AA of Customs Act, 1962 justified. [para 26]

Penalty - Appellant No. 2 namely Shri Rony Abraham, Manager Sales

and appellant No. 3 namely Shri Ankur Bhatia, Director of the Appellant No. 1

fully aware that appellant company importing complete Segway electrically

operated product in CKD condition by misdeclaring the same as CKD parts of

components - Both of them instrumental and devising a modus operandi to

evade Customs duty by wrongly availing the benefit of the Notification No.

12/2012-Cus. - Considering the involvement of both the appellants in entire

activity, imposition of penalty on them under Sections 114A and 114AA of

Customs Act, 1962 justified. [para 27]

EXCISE LAW TIMES 15th July 2020 285