Page 298 - ELT_15th July 2020_Vol 373_Part 2

P. 298

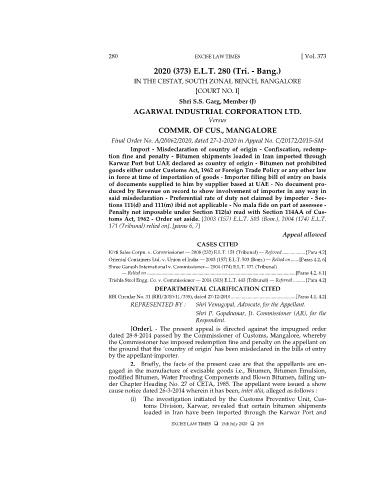

280 EXCISE LAW TIMES [ Vol. 373

2020 (373) E.L.T. 280 (Tri. - Bang.)

IN THE CESTAT, SOUTH ZONAL BENCH, BANGALORE

[COURT NO. I]

Shri S.S. Garg, Member (J)

AGARWAL INDUSTRIAL CORPORATION LTD.

Versus

COMMR. OF CUS., MANGALORE

Final Order No. A/20062/2020, dated 27-1-2020 in Appeal No. C/20172/2015-SM

Import - Misdeclaration of country of origin - Confiscation, redemp-

tion fine and penalty - Bitumen shipments loaded in Iran imported through

Karwar Port but UAE declared as country of origin - Bitumen not prohibited

goods either under Customs Act, 1962 or Foreign Trade Policy or any other law

in force at time of importation of goods - Importer filing bill of entry on basis

of documents supplied to him by supplier based at UAE - No document pro-

duced by Revenue on record to show involvement of importer in any way in

said misdeclaration - Preferential rate of duty not claimed by importer - Sec-

tions 111(d) and 111(m) ibid not applicable - No mala fide on part of assessee -

Penalty not imposable under Section 112(a) read with Section 114AA of Cus-

toms Act, 1962 - Order set aside. [2003 (157) E.L.T. 503 (Bom.), 2004 (174) E.L.T.

171 (Tribunal) relied on]. [paras 6, 7]

Appeal allowed

CASES CITED

Kirti Sales Corpn. v. Commissioner — 2008 (232) E.L.T. 151 (Tribunal) — Referred ................... [Para 4.2]

Oriental Containers Ltd. v. Union of India — 2003 (157) E.L.T. 503 (Bom.) — Relied on ....... [Paras 4.2, 6]

Shree Ganesh International v. Commissioner— 2004 (174) E.L.T. 171 (Tribunal)

— Relied on ............................................................................................................................ [Paras 4.2, 6.1]

Trishla Steel Engg. Co. v. Commissioner — 2014 (313) E.L.T. 443 (Tribunal) — Referred .......... [Para 4.2]

DEPARTMENTAL CLARIFICATION CITED

RBI Circular No. 31 (RBI/2010-11/335), dated 27-12-2010 ...................................................... [Paras 4.1, 4.2]

REPRESENTED BY : Shri Venugopal, Advocate, for the Appellant.

Shri P. Gopakumar, Jt. Commissioner (AR), for the

Respondent.

[Order]. - The present appeal is directed against the impugned order

dated 28-8-2014 passed by the Commissioner of Customs, Mangalore, whereby

the Commissioner has imposed redemption fine and penalty on the appellant on

the ground that the ‘country of origin’ has been misdeclared in the bills of entry

by the appellant-importer.

2. Briefly, the facts of the present case are that the appellants are en-

gaged in the manufacture of excisable goods i.e., Bitumen, Bitumen Emulsion,

modified Bitumen, Water Proofing Components and Blown Bitumen, falling un-

der Chapter Heading No. 27 of CETA, 1985. The appellant were issued a show

cause notice dated 26-3-2014 wherein it has been, inter alia, alleged as follows :

(i) The investigation initiated by the Customs Preventive Unit, Cus-

toms Division, Karwar, revealed that certain bitumen shipments

loaded in Iran have been imported through the Karwar Port and

EXCISE LAW TIMES 15th July 2020 298