Page 294 - ELT_15th July 2020_Vol 373_Part 2

P. 294

276 EXCISE LAW TIMES [ Vol. 373

India for further sale with the simple screw driver technology. It is also matter of

fact that the parts such as Power Base, Gear Box were imported in assembled

forms and not in CKD condition and thus these crucial parts were assem-

bled/ready to use components for further assembly of ‘Segway’ product.

20. For deciding the appropriate classification for imported consign-

ments of the Segway in CKD condition it will be appropriate to have look at the

relevant Customs Tariff Headings 8711 and 8714.

21. It can be seen that Chapter 8711 covers primarily motorcycles and

like products which includes mopeds, side cars, scooters as well as electrically

operated bicycles. It is relevant to mention here that Harmonization Committee

of the World Customs Organization in its 58th Session of the Committee has fur-

ther elaborated the scope of classification under Chapter Heading 8711 to cover

the products such as self-balancing, electrically power two wheel transportation

devices which are known by various names, such as, hover board, smart scooter,

drift vehicle. The relevant extract is reproduced here below :-

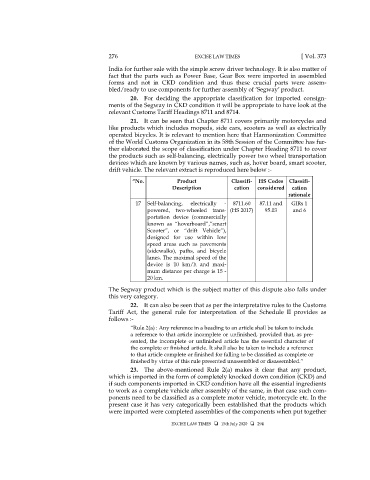

“No. Product Classifi- HS Codes Classifi-

Description cation considered cation

rationale

17 Self-balancing, electrically - 8711.60 87.11 and GIRs 1

powered, two-wheeled trans- (HS 2017) 95.03 and 6

portation device (commercially

known as “hoverboard”,”smart

Scooter”, or “drift Vehicle”),

designed for use within low

speed areas such as pavements

(sidewalks), paths, and bicycle

lanes. The maximal speed of the

device is 10 km/h and maxi-

mum distance per charge is 15 -

20 km.

The Segway product which is the subject matter of this dispute also falls under

this very category.

22. It can also be seen that as per the interpretative rules to the Customs

Tariff Act, the general rule for interpretation of the Schedule II provides as

follows :-

“Rule 2(a) : Any reference in a heading to an article shall be taken to include

a reference to that article incomplete or unfinished, provided that, as pre-

sented, the incomplete or unfinished article has the essential character of

the complete or finished article. It shall also be taken to include a reference

to that article complete or finished for falling to be classified as complete or

finished by virtue of this rule presented unassembled or disassembled.”

23. The above-mentioned Rule 2(a) makes it clear that any product,

which is imported in the form of completely knocked down condition (CKD) and

if such components imported in CKD condition have all the essential ingredients

to work as a complete vehicle after assembly of the same, in that case such com-

ponents need to be classified as a complete motor vehicle, motorcycle etc. In the

present case it has very categorically been established that the products which

were imported were completed assemblies of the components when put together

EXCISE LAW TIMES 15th July 2020 294